- An advanced diploma of financial planning (including the historical 8 course Diploma of Financial Planning)

- Completion of approved coursework to attain a designation

In this final version, however, the Authority has added a third avenue for recognition of prior learning, which is:

- Completion of relevant degree subjects

For this additional avenue, FASEA notes: “Advisers holding a non-relevant degree who have completed between 4 and 7 of the relevant degree knowledge areas will be awarded 2 credits as recognition of prior learning.”

Following industry feedback, the term ‘relevant degree’ has also been expanded to include financial planning and investments studies. FASEA states: “Financial planning (including financial advice areas of superannuation, retirement, insurance and estate planning) and investments (including investments such as shares, derivatives, foreign exchange and options) have been added as relevant degree subjects.

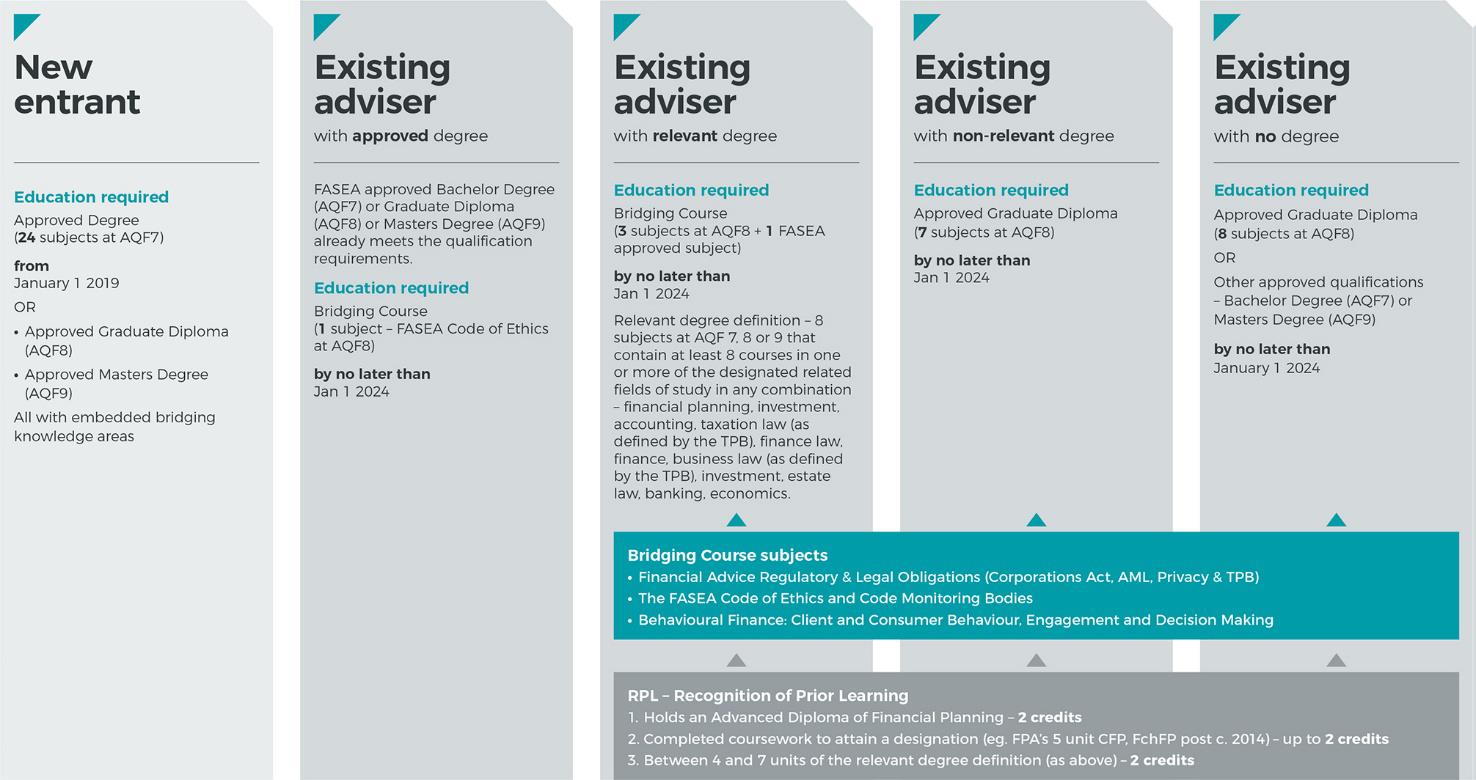

The following table details the recognition of prior learning and the consequent number of subjects that will be required of advisers for each of the different pathways defining existing advisers:

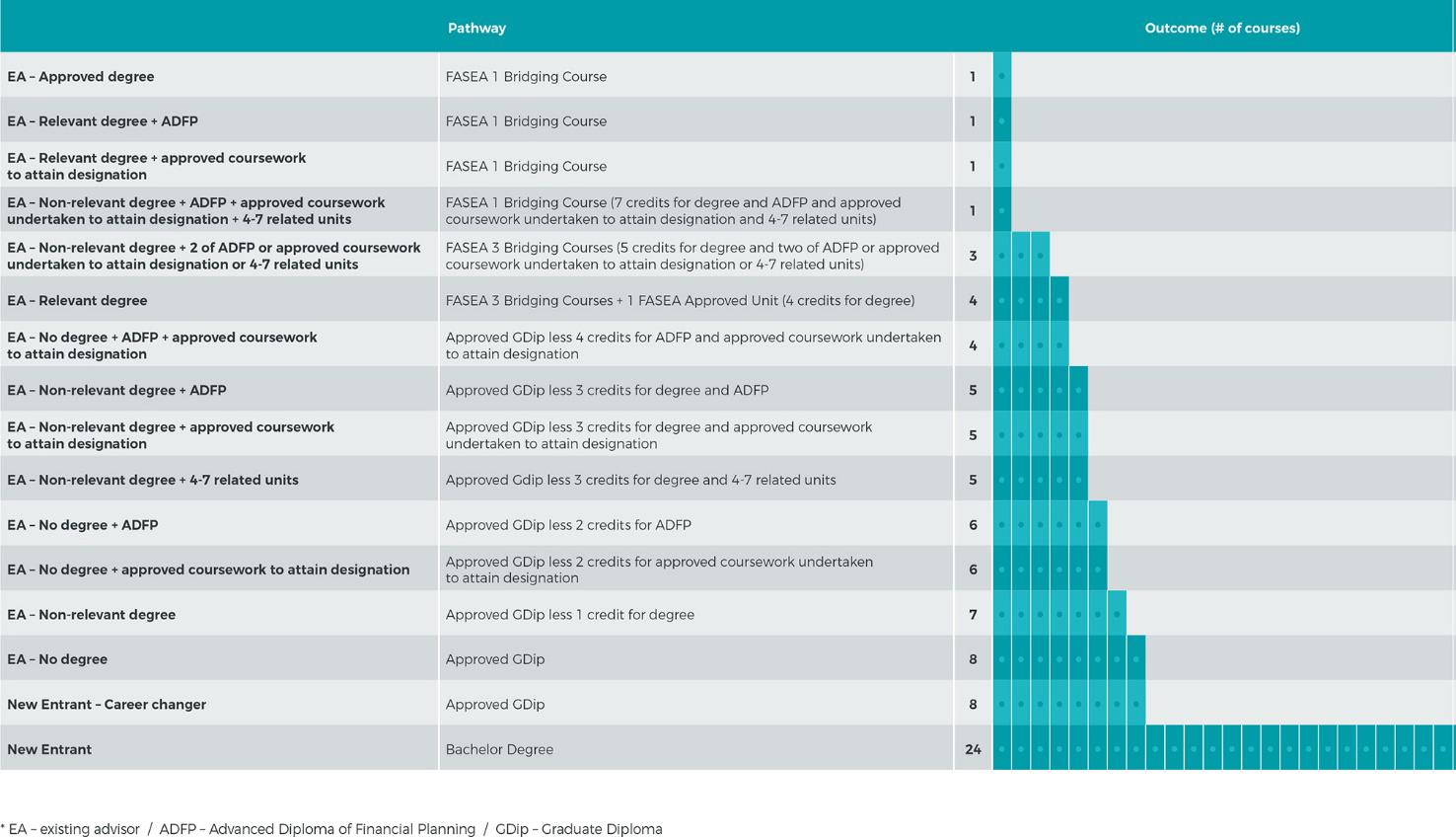

This second table, also taken from the Authority’s final FPS001 Education Pathways Policy, provides a summary of FASEA education pathways for both new entrants and existing advisers:

Advisers can click here to access the final version of the Financial Adviser Standards and Ethics Authority’s Education Pathways Policy.