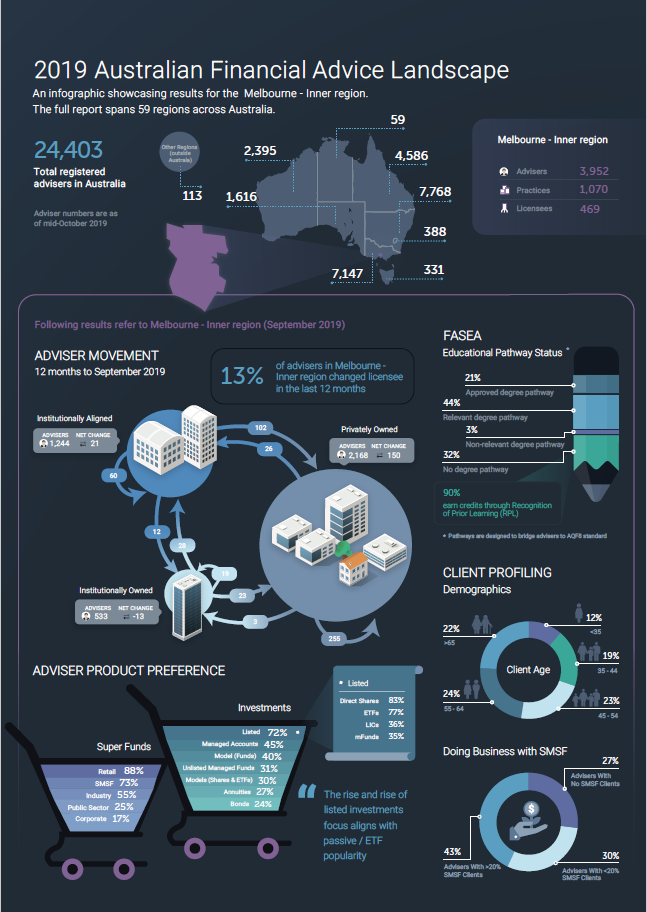

Major regulatory action post the Australian Royal Commission, combined with strategic exits by major banks along with a 50 percent increase in exits from major institutions, is transforming the shape of the financial advice industry, according to the 2nd Australian Financial Advice Landscape Report by Adviser Ratings.

The research firm reports that advisers across the Ditch are voting with their feet, with a 50 percent increase in exits from major institutions and adviser retirements at 18 percent annualised.

Its original five-year forecast remains on track for an advice market that will shrink to 15,000 advisers with $900 billion of wealth in transition.

“The advice industry is changing shape in the blinking of an eye,” said Adviser Ratings CEO, Mark Hoven, in a media release.

“The continued mass migration of advisers in 2019 has been defined by the synchronized withdrawal from advice by the major banks, and AMP rebalancing,” he said.

To end of November 2019, the research reported 3,100 adviser exits (+50 percent pa) including 1,900 switches (+57 percent pa) out of the Big Six wealth institutions, primarily into privately-owned licensees.

The report notes that adviser departures remain high with 15 percent of advisers having exited by the end of October last year, although there was a marked slowdown in Q3 following the government’s announced extensions for advisers to meet FASEA educational standards deadlines.

“Our latest research provides a much clearer picture of the education gap confronting the advice industry, and it’s not as bad as some of the commentary suggests,” said Hoven. Eighteen percent of advisers already meet the qualification standard while another 42 percent have to complete four subjects only.

The report also found that adviser revenue is under extraordinary pressure.

“Should the government legislate the proposed 2021 / 2026 FASEA deadline extensions next year, more advisers may choose to stay and study.”

The report also found that adviser revenue is under pressure with the end to grandfathering by 2021, more staged reductions in life insurance commissions, and other commercial restraints driven by FASEA Code of Ethics reform.

To reduce the bleeding, advisers are actively responding by:

- Shedding their unprofitable clients

- Raising fees on average 12 percent to $2,800

- Moving away from asset-based pricing with the balance of fixed fees rising to 70 percent of total revenue earned

“We are witnessing advisers rebalancing their business models to become more focused in specialised areas or embracing the integrated services model that combines financial advice with accounting and mortgage broking,” said Encore Advisory Group CEO Tom Reddacliff, who was a key contributor to the report.

The report also revealed that financial uncertainty is driving turnover of advice businesses, compounding adviser and adviser-client instability. Adviser Ratings research identifies around 1,500 practices representing 17 percent of the market, advising $190 billion of wealth, are looking to sell their business.

“With income eroded due to regulatory impacts and valuation multiples falling on retained revenue, many of these practices are forced sellers and invariably price takers,” said Reddacliff.

More than 80 percent of these businesses have less than four advisers, while only the larger practices, typically with revenue above $500,000, are likely to be sold as going concerns.

The statement says that digital advice, delivered by automated personal finance tools, is emerging as the new frontier for the wealth industry.

“Digital advice is a genuine solution to help more consumers with their personal finances, and for advice firms as an alternative to orphaning their unprofitable advised clients,” said Hoven.

“Seventy two percent of institutions and 79 percent of smart tool providers that we surveyed are confident about the future of the digital tools sector. However, this fledgling sector remains challenged by lack of scale and brand and is looking for institutional partners, primarily banks, super funds, advice licensees and asset managers.”

Click here to access a detailed outline of the report that includes an infographic of the average Australian adviser.