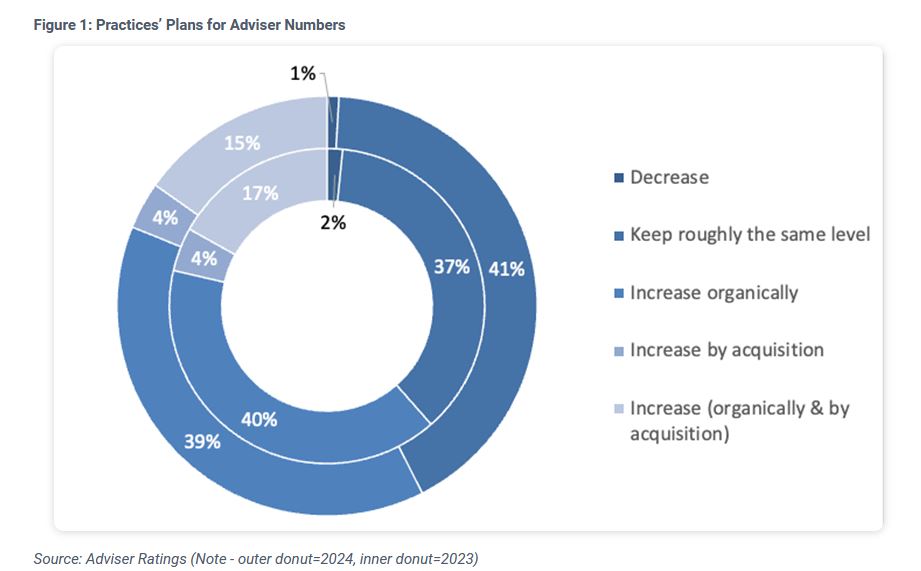

The Australian financial advice industry is showing a trend towards stability in practices’ adviser numbers for 2024, with fewer firms planning significant increases compared to 2023, according to Adviser Ratings.

In looking at financial advisers’ growth decisions the research firm says, in commentary on its website, that the industry is experiencing notable changes, particularly in how companies and practices plan to adjust the number of financial advisers they employ.

It points to a recent survey where businesses in Australia were asked about their future plans regarding adviser numbers.

“The responses reveal interesting trends when comparing data from 2023 to 2024 … notably, more companies plan to maintain stable adviser numbers while leveraging technology for efficiency”.

Adviser Ratings says there has been a noticeable shift in the industry’s approach to growth and staffing.

Adviser Ratings says there has been a noticeable shift in the industry’s approach to growth and staffing.

In 2023, many companies were more inclined to expand their adviser teams through organic growth and acquisitions. However, in 2024, a more conservative approach is emerging.

“Fewer companies are looking to increase their adviser numbers aggressively, instead focusing on maintaining current levels. This shift suggests that firms are becoming more cautious and possibly more strategic in their expansion plans, potentially in response to market conditions or other external factors.”

The company notes too that technology and artificial intelligence are increasingly influencing how companies make strategic decisions about adviser growth.

It says that in 2024, firms are incorporating advanced technological tools and AI into their planning processes.

…These technologies offer enhanced data analytics capabilities, enabling companies to make more informed decisions about when and how to expand their adviser teams…

“These technologies offer enhanced data analytics capabilities, enabling companies to make more informed decisions about when and how to expand their adviser teams. By leveraging AI, firms can better predict client needs, optimise resource allocation, and streamline operations, which helps in aligning adviser growth with overall business performance and market trends.”

Adviser Ratings says these shifts indicate a cautious approach in 2024, with more companies opting to maintain their current adviser levels rather than pursue aggressive growth strategies.

“This trend could be reflective of broader economic conditions or industry-specific challenges. The stability in acquisition plans suggests that mergers and acquisitions are not the primary growth strategy for most firms, potentially due to the complexities and costs associated with such actions.”

It also points to a strong correlation between a company’s recent performance and its plans for adviser numbers. Among companies that experienced a revenue decrease over the past 12 months, only 35% plan to increase their adviser numbers. In contrast, 63% of companies that saw revenue growth intend to expand their adviser teams, and none of these companies plan to reduce their adviser numbers.

“This relationship underscores the impact of financial health on strategic staffing decisions.”

The company adds that a similar pattern emerges when examining the acquisition of new clients over the previous 12 months. Companies that successfully acquired more clients are more likely to increase their adviser numbers.

The company adds that a similar pattern emerges when examining the acquisition of new clients over the previous 12 months. Companies that successfully acquired more clients are more likely to increase their adviser numbers.

“This trend highlights the importance of client growth as a driver for expanding advisory teams, suggesting that firms with growing client bases feel confident in their ability to support and benefit from additional advisers,” Adviser Ratings says.