A new report finds that in retirement planning, ‘fear of running out’ (FORO) may lead to over-saving, thereby reducing quality of life, while in retirement it may cause under-spending even when sufficient funds are available.

The latest New Zealand Retirement Expenditure Guidelines also found that underpinning this FORO is the uncertainty around life span — essentially, the question of life expectancy or simply, “How long will I live?”, noting this is a question that no one can answer with certainty.

Financial Advice NZ says the guidelines provide valuable data to financial advisers in guiding their clients through retirement planning.

The organisation says the report, by the Financial Education and Research Centre at Massey University with Financial Advice NZ’s support, offers “crucial insights” into the spending patterns and financial needs of retired New Zealanders.

This 13th edition highlights “…the dynamic nature of retirement planning, emphasising the need for regular reviews to adapt to changing economic conditions.”

Financial Advice NZ also notes in a statement that with the first of Generation X approaching retirement and Millennials beginning to consider their future “…this research underscores the importance of early and ongoing financial planning.”

It adds that a central question for those preparing for retirement is determining the level of financial resources needed to meet their needs.

“The Guidelines provide insights into actual spending levels among retired New Zealanders, helping individuals plan budgets for their desired retirement lifestyle and estimate the savings required to achieve their goals.”

Longevity Risk

One of the key concerns addressed in the report is longevity risk – the risk of outliving one’s savings.

…Effective planning requires strategies to manage this risk, ensuring a sustainable income throughout retirement…

“Effective planning requires strategies to manage this risk, ensuring a sustainable income throughout retirement. The report also explores the impact of inflation on expenditure and the importance of considering various income sources beyond NZ Superannuation.”

Nick Hakes, CEO of Financial Advice NZ, says its members “…play a critical role in helping individuals navigate these complexities.”

“The data and insights from the guidelines equip advisers with information on spending patterns and the financial needs of retired New Zealanders, to assist with providing tailored professional advice that addresses longevity risk, optimises savings, and ensures a comfortable retirement.”

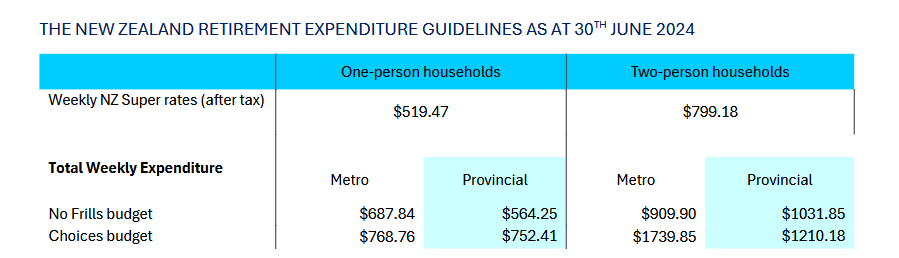

Associate Professor Claire Matthews of Massey University states that as households continue to spend at levels in excess of NZ Superannuation “…New Zealanders need to consider the changing economic environment to determine the savings they need to achieve their retirement objectives.”

Key Findings

- A majority of New Zealanders hope to enjoy a standard of living in retirement that exceeds what NZ Superannuation alone can provide

- Most households where NZ Superannuation currently counts as one of their income sources have successfully achieved this

Life expectancy:

- In retirement planning, ‘fear of running out’ (FORO) may lead to over-saving, thereby reducing one’s quality of life, while in retirement it may cause under-spending even when sufficient funds are available

- Underpinning this FORO is the uncertainty around life span — essentially, the question of life expectancy or simply, “How long will I live?”, which is a question that no one can answer with certainty

- Life expectancy changes as one ages and varies over time across different cohorts

- Individual life expectancy is influenced by several factors: genetics, lifestyle, gender, ethnicity, and socioeconomic factors

- New Zealanders are fortunate to have access to a guaranteed lifetime annuity in the form of NZ Superannuation, which protects people from longevity risk

Expenditure changes from 2023 to 2024:

- The effect of inflation on expenditure for each of the household groups was in the range of 1.80% to 3.46%, with only two household groups having an effective inflation rate above the CPI rate of 3.30% for the same period

- The key drivers for increased costs for superannuants for the 12 months ended 30th June 2024 were housing and household utilities, transport, and insurance for all the household groups

- The household groups considered in the report are spending more than is received from NZ Superannuation, reflecting access to other income and/or savings

Click here to see the full report.