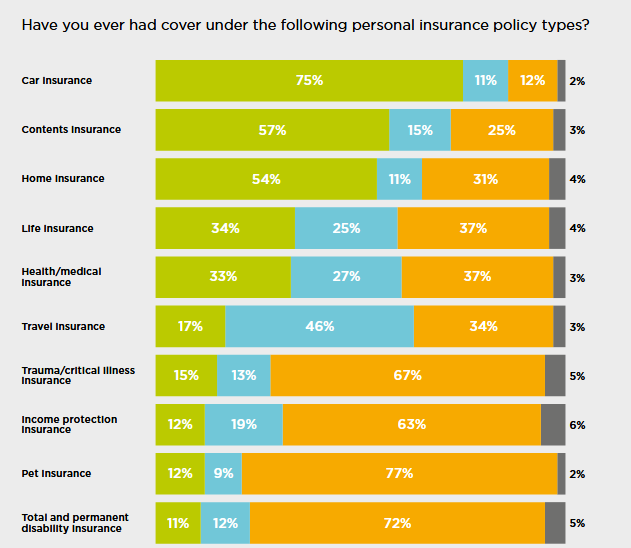

While New Zealanders are quick to insure their cars, homes, and gadgets, they’re far less likely to protect their health, income, and lives, the FSC’s latest research has found.

Titled Money & You: Valuing Belongings Over Ourselves, the FSC says the report shows that New Zealanders are twice as likely to have car insurance than life or health insurance.

FSC CEO Kirk Hope says the research shows New Zealanders instinctively protect their homes, cars and possessions “…but when it comes to insuring their most valuable asset, themselves, there’s a striking disconnect.”

[In the table below: green is ‘yes, I currently do’; blue is ‘I previously had this insurance but no longer do’; orange is ‘no, never’; grey is ‘unsure’.]

“For those that do have life and health insurance, most Kiwis are paying for it out of their own pockets rather than receiving it through an employer remuneration package,” says Hope.

The research found that 78% of New Zealanders pay for life insurance and 56% for health insurance themselves, rather than through employer-provided schemes.

…With cost being a barrier, expanding access to insurance through workplace schemes would boost uptake…

“With cost being a barrier, expanding access to insurance through workplace schemes would boost uptake and improve coverage across the population,” says Hope.

He says the FSC has identified a required policy shift: exempting employer contributions to life and health insurance from Fringe Benefit Tax “…would remove a key barrier, enabling more New Zealanders to access essential cover through their workplaces.”

He says that FBT on employer-provided group insurance schemes discourages businesses, particularly SMEs, from including insurance as an employee benefits, adding that there are important policy implications here.

“Improving access to life and health insurance can enhance workforce resilience, reduce pressure on the public health system, and provide critical financial buffers for families and individuals in times of crisis. This tax effectively penalises employers for supporting the wellbeing of their staff.”

The report also found that when seeking financial advice, more people engage with advisers for mortgages and KiwiSaver than for insurance decisions.

Other key findings from Money & You: Valuing Belongings Over Ourselves include:

- Contents, home, and car insurance are more often seen as providing peace of mind than life insurance

- People who hold insurance generally recognise its value, particularly health insurance, which provides faster access to care, lowers out-of-pocket costs, and supports overall wellbeing, enabling a quicker return to work and daily life

- 85% of respondents report a moderate to very good understanding of life insurance products

- The rising cost of living is the leading reason for cancelling or avoiding insurance, though life and health policies are less likely to be dropped for this reason compared to others

- 72% of New Zealanders have made an insurance claim, most commonly for car, health/medical, or contents insurance.

Click here to download the full report.