Two thirds of Australian advisers think a revised risk commission model proposed by actuary John Trowbridge would not sustain a viable advice practice.

This is the main message stemming from a poll run on our sister site RiskInfo.com.au which asked advisers to assess Trowbridge’s call for the Australian Government to re-think the remuneration model for risk advice, which it implemented through its Life Insurance Framework reform legislation (see: Call for Re-Think on Risk Commissions).

As we go to press, two thirds of those voting (66%) have rejected the 2020 Trowbridge model. However, 23% believe the AU$2,000 IAP accompanied by a flat 20% commission and no clawbacks could work. Around one in 10 of poll voters (11%) are unsure.

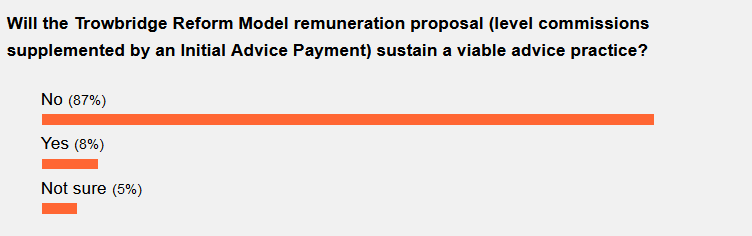

The poll has delivered a similar result to the same question in 2015 about the original Trowbridge reform model, where a significantly higher proportion gave the proposal a thumbs-down.

Comments from advisers on the proposal include:

- For life insurance to be accessed properly by consumers it needs to be accompanied by advice

- The 60/20 commission model, two-year clawback period operating under the Life Insurance Framework reforms is unsustainable for advisers and limits their ability to advise mums and dads clients

- The industry should be allowed to return to an 80/20 commission model with a one-year clawback period

…The proposed Trowbridge model is not viable as it is a one-dimensional approach to a multi-faceted problem

- The updated Trowbridge proposal discriminates against advisers who work with larger risk insurance clients with more complex insurance needs

- This is a free market economy

- The proposed Trowbridge model is not viable as it is a one-dimensional approach to a multi-faceted problem

- Either the compliance burden needs to be reduced or commission rates to be increased or a mix of both

Representing the almost one in four who think the new Trowbridge commission model is sustainable, one adviser noted the model might create sufficient incentive for risk advisers to stay in the industry or even return.

Finally, another strong message or theme which has remained ever-present in recent years is the frustration felt by many advisers that their voice is not being heard, and that the regulatory and political decision-makers in Australia aren’t listening to, or consulting enough, with the adviser community.