Australia’s Financial Services Council has released a new research report which advocates for a radical overhaul of the country’s financial advice system.

Conducted for the FSC by research firm, Rice Warner, the report calls for a restructuring of the financial advice sector to make advice more affordable and accessible to consumers.

Positioned by the FSC as ‘groundbreaking’ research, the recommendations, if implemented, may serve as a game-changing development for the future of financial advice in general and potentially for life insurance advice, in particular.

At the heart of the report’s recommendations is a call to legally re-define the term ‘financial advice’ into component elements of General Information and Personal Advice, where the degree of advice complexity corresponds with the perceived risk to which the client may be exposed:

- General Information – which incorporates the existing definitions of Education, Information and General Advice

- Personal Advice – to be simplified by separating it into Simple and Complex based on the extent of risk for the consumer:

- Simple Personal Advice – advice that deals with well understood financial needs and financial products. Specifically, those that are nominated under ASIC’s Design and Distribution Obligations as being for average family consumers.

- Complex Personal Advice – advice that is not simple advice but should also specifically include products and strategic topics that are known to be complex and/or risky

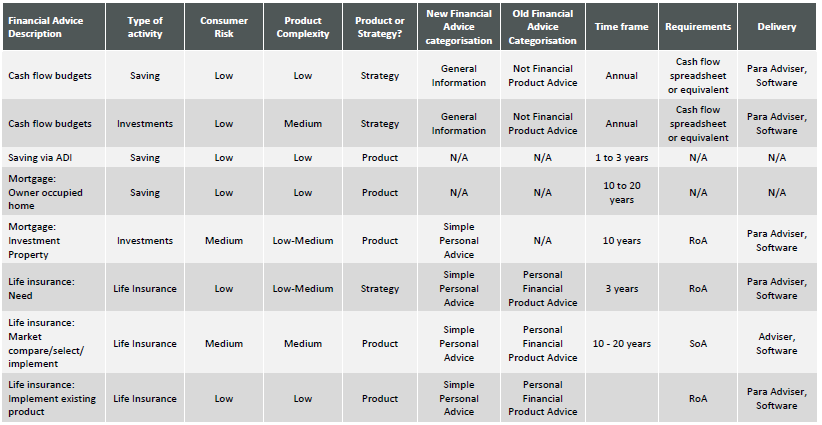

Taken from the Rice Warner report, entitled Future of Advice, this chart is a visual representation of the proposed new definitions of financial advice in Australia:

The report considers the need for advice and the value of advice within its summary of the current regulatory regime and then it offers a proposed new model, which is intended to deliver:

- Simplification

- Affordability

- Accessibility

- Consistency

- Quality of advice

It cites an example where three different life insurance-related advice scenarios can fall into either simple or complex advice categories:

“Another example is someone buying life insurance for the first time. This could be categorised as Simple Personal Advice if simply adding to the cover in their MySuper product, but Complex Personal Advice if they consider all life insurance needs for an individual, family or business.

“However, any later discussions, renewal or product changes should be easier for a consumer to understand and should carry lower risks. Therefore, the later advice could be downgraded to Simple Personal Advice.”

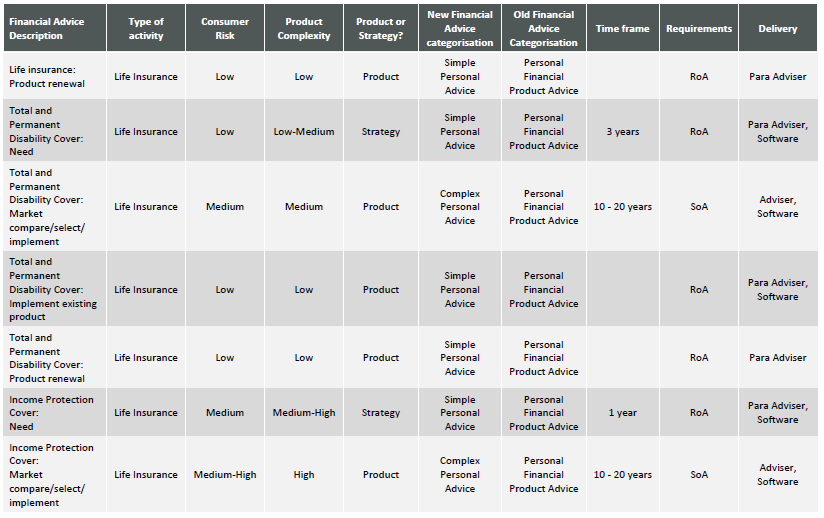

In addition to drilling down further into the types of advice under the proposed structure and giving consideration to client best interest scenarios, code of ethics and FASEA requirements, the report also includes a set of sample mappings that describe the type of financial advice, the risk to the consumer and the requirements that would be stipulated for the delivery of that particular advice solution. Life insurance advice-related tables are set out below:

In referring to the current FASEA education standards, the report notes that “…while the objective of higher standards is admirable, the implementation has been woeful.”

It notes the law regards all Financial Advice (outside single-issue advice) to be complex and risky for consumers, but: “In many cases, the regime enforces an unnecessary expensive complex process which simply increases costs.”

The FSC says it will consider Rice Warner’s research as well as engaging extensively with stakeholders, including financial advisers, ahead of launching a policy document or Green Paper on Financial Advice next year, which it says is a critical step in policy development.

FSC CEO, Sally Loane, said: “The aim is to build a new model for financial advice which not only makes professional quality advice more affordable and accessible for consumers, but also removes the mass of costly compliance and regulatory burden on the sector.”

Click here to read the Future of Advice Report.