The underinsurance gap in Australia is widening, concludes a new report released by Rice Warner.

The consulting and research firm’s Underinsurance in Australia 2020 report notes the impact of superannuation legislation – including the Protecting Your Super (PYS) and Putting Members’ Interests First (PMIF) reforms – has allowed the true extent of the underinsurance gap in Australia to become clear.

…our research shows that the underinsurance gap has widened since our last research in 2017

The report notes there has been a significant increase in the amount of insurance cover provided to the community though superannuation funds over the last ten years and that the underinsurance gap had been significantly reducing as a result. However, a release accompanying the report goes on to say that “…in light of the current insurance landscape, and the greater clarity that PYS and PMIF has introduced, our research shows that the underinsurance gap has widened since our last research in 2017.”

Other underinsurance-related findings highlighted by Rice Warner include:

- On a basic level of insurance needs, the current level of insurance held covers 92 percent of death needs but only 29 percent of TPD needs

- Generally, TPD Insurance needs exceed the needs for death insurance, more so at younger ages and particularly when there are no dependents

- The underinsurance gap is much greater for parents with young children

In terms of the consequences for the Australian economy, Rice Warner states that underinsurance is a direct cost for the Government in terms of additional social security and other related payments, particularly for Australians on modest incomes. It says it has estimated the current total cost to the Government in social security payments of death and TPD underinsurance across Australia to be well over $600 million per annum, noting this estimate is based on the income replacement level of death and TPD needs.

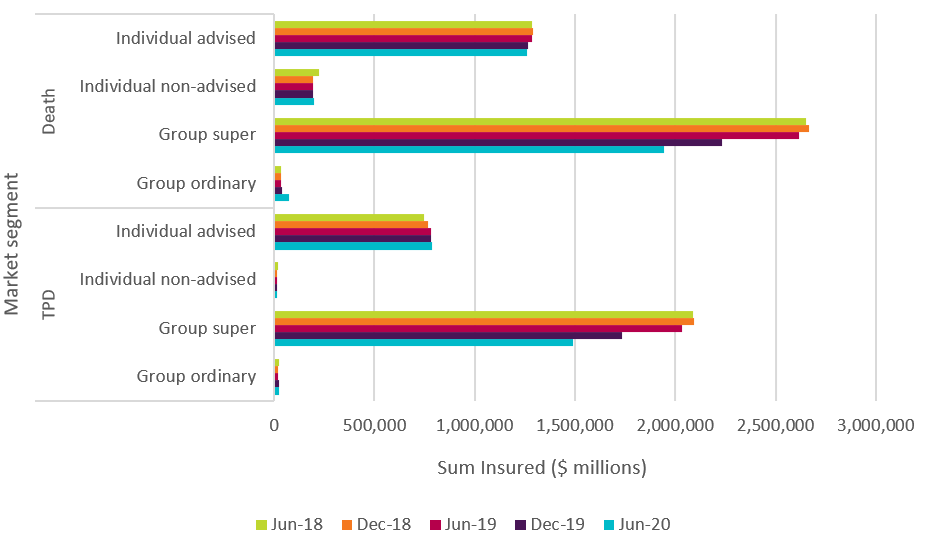

Reporting the changing levels of cover by market segment for death and TPD cover, based on APRA’s Life insurance claims and disputes statistics data at 30 June 2020, Rice Warner reports the total sum insured across all distribution channels has decreased by 17 percent for death cover and 19 percent for TPD cover since June 2018. It characterises this as a significant reduction, driven mostly by the drop in group insurance cover inside superannuation, being 27 percent for death cover and 29 percent for TPD cover.

It also says retail advised insurance new business volumes sales have been reducing, due – it says – to a reduction in active insurance advisers. The firm claims the aggregate sum insured held via this distribution channel has been decreasing since the end of 2018 and that “…it will be challenging to completely reverse this trend”.