An online platform where consumers can store details of their insurance policies is to start offering products direct to the public.

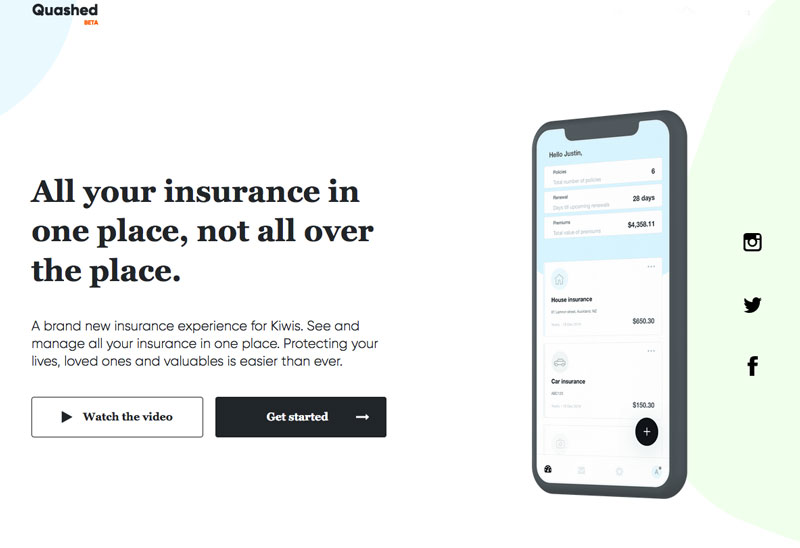

Quashed provides its members with a free service to lodge their policies, premiums, and the amounts they are protected for, so they can see all their insurance details on one screen.

The firm was launched in December 2019 and according to Companies Office its directors are Wenbo Li, Justin Lim (CEO) and Shaun Quincey.

Lim says around 200 people are joining Quashed every month, and that insurance companies and advisers, see “…tremendous value in the platform as it enables more consumers to actively engage with insurance and gain a better understanding of their products”.

Following a banking career in New Zealand and Singapore, Lim says he saw an opportunity to bring the insurance industry in line with online banking, where consumers can use any digital device to manage their accounts.

Quashed is being supported by the Icehouse Venture fund and has raised $600,000 in funding with support from private investors such as Quashed board member Shaun Quincey, who founded fintech firm Genoapay, and Mike Ballantyne (no connection to Partners Life), a co-founder of PredictHQ and travel booking business Online Republic.

Lim says the Quashed platform uses artificial intelligence and machine learning to interpret thousands of policy documents to build a risk profile for each member.

He says the site will allow consumers to buy and renew policies directly from the platform.

“We see a future where everyone can use our platform to seamlessly browse, buy and manage all of their insurance needs to get the best coverage at the best price point,” says Lim.