The rising costs of medical care is behind nib’s decision to increase its health insurance premiums.

In a statement to advisers the firm says healthcare expenses continue to grow as the cost and frequency of medical treatment increases.

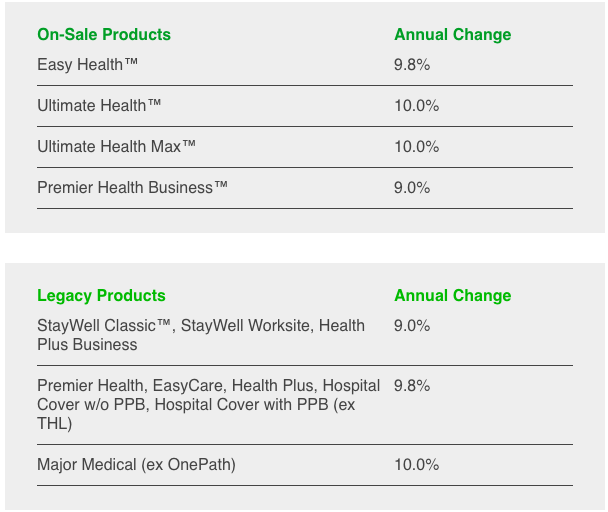

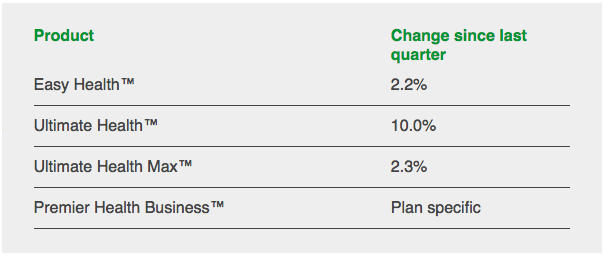

For the upcoming quarter, nib’s clients will see an average 9.7% annual increase for renewing policies (see tables below). However, the company says changes in premiums will vary depending on each member’s benefits, options and excess, who the policy covers, and whether the premium includes a policy fee.

Members whose policy anniversary does not fall within the April – June quarter won’t see any change to their premiums until their next policy anniversary.

The company says factors that can contribute to premium changes include:

- Changes in cover terms for any of the people covered

- Changes in the ages of people covered

- Adding or removing people from the policy

- A move from group cover to individual cover terms and conditions

- Loss of a Premium No Claims Discount or change in a five-year age band (these only apply to some legacy products).

- Premiums included in quotations for prospective new members will be updated from 1 April 2021.

- For Ultimate Health Max premium increases are spread across each quarter throughout the year

- For Ultimate Health most of the annual increase occurs on 1 April each year

The new rates will be automatically updated in nib illustrations and nibAPPLY. Advisers using nib Illustrator and/or Fidelity Life desktop Apollo quoting software should download the update before 31 March 2021.

Quotations dated before 1 April 2021 will be honoured if the application goes into force within 30 days of the quotation date.

For advisers who service group health insurance schemes, the premium increases only apply to the individual members within a group where they have:

Enhanced their group health insurance cover terms; or

Added family or added optional benefits that they pay for personally

The increase will apply to the portion of their health insurance premium relating to the enhanced cover terms and optional benefits, in the same way as those of members with individual covers. The member’s direct debit or payroll deduction will also change accordingly. Any increase in the group scheme’s premiums will be determined according to the scheme terms and conditions and will be paid for by the scheme owner.