Latest life insurance claims and disputes statistics out of Australia continue to demonstrate the advantage consumers who are advised have when compared to non-advised consumers.

APRA’s latest Life Insurance Claims and Disputes Statistics state that generally, Individual Advised business shows higher admittance rates than Individual Non-Advised for the same cover type.

This is a continuation of the trend seen for the 12 months to December 2020 (see: New Claims Data Reinforces Value of Advisers) and prior to that for the period to June 2020 (see: Claims by Advised Clients More Likely to Succeed).

The latest publication presents the key industry-level claims and dispute outcomes for 20 Australian life insurers writing direct business (i.e. excluding reinsurance), covering a rolling 12-month period from 1 July 2020 to 30 June 2021.

APRA notes that the admittance rate across all cover types and distribution channels was 93 percent in the reporting period.

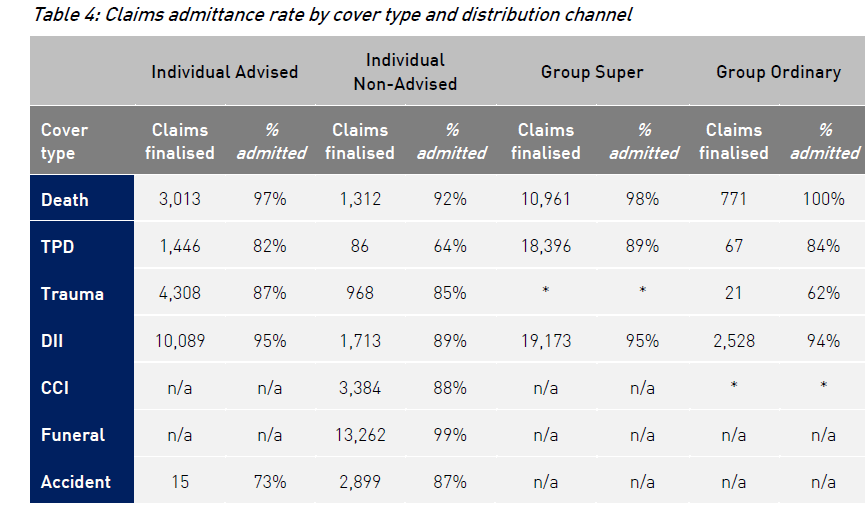

And the admittance rate by cover type and distribution channel shows that for death cover, Individual Advised claims admitted sat at 97 percent compared with 92 percent of Non-Advised.

TPD cover claims admitted sat at 82 percent Advised (64 percent Non-Advised) and Trauma saw 87 percent Advised claims admitted (85 percent Non-Advised).

Under DII cover 95 percent of Advised claims were admitted against 89 percent of Non-Advised.

APRA notes that the admittance rate tables reveal significant variance in the admittance rate between different cover types and distribution channels, from 100 per cent (Group Ordinary Death) to 62 per cent (Group ordinary Trauma).

APRA notes that the admittance rate tables reveal significant variance in the admittance rate between different cover types and distribution channels, from 100 per cent (Group Ordinary Death) to 62 per cent (Group ordinary Trauma).

It says these results, however, are affected by the number of observations – the latter combination only reflects 21 finalised claims, whereas 13 out of the 20 combinations have more than 1,000. The table above shows the number of finalised claims for each combination.

While generally Individual Advised business shows higher admittance rates than Individual Non-Advised for the same cover type, APRA says this could be due to the policyholder having clearer expectations up front of what is covered by the product, or (related to the previous point) the adviser discouraging the policyholder from lodging a claim that is not covered by the policy.

“The exception is Individual Advised Accident, which has an unusually low admittance rate. However, …the number of observations is quite small (15 finalised claims, versus 2,899 for Non-Advised).”