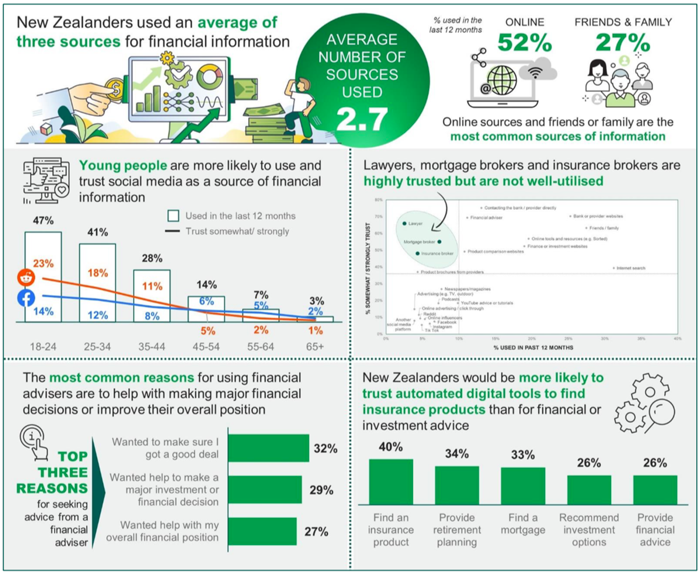

Strongly resonating with advisers this week was news that just under two in five consumers have consulted with an adviser in the past 12 months…

Financial advisers are deemed to be the second most trusted source of financial advice for most Kiwis according to a survey carried out by the FMA.

Other findings in its Consumer Experience with the Financial Sector report are that just under two in five (18%) consumers have used a financial adviser in the past 12 months, and that those who have used an adviser are more likely to be male and have an annual household income of $150,000 or more.

The survey results also show that one-third of people (31%) feel nervous about speaking to financial services providers, and a quarter (26%) find it difficult to identify suitable financial products.

FMA CEO Samantha Barrass says while consumers are generally content with their financial service providers, with bank customers (71%) and insurance company customers (70%) satisfied. The satisfaction rate of KiwiSaver provider and fund manager customers was lower at 61%.

Scores for trust were lower than those for satisfaction, with only 48% of consumers trusting insurance companies.

The survey found that:

- Females have a higher degree of trust in banks and insurance companies than males

- People aged 18-34 are more likely to trust financial advisers and insurance brokers /

advisers than people aged 55 and over - People on higher incomes generally have a higher level of trust in all financial institutions except insurance companies

When it comes to consumers buying life products:

- 34% bought direct from the insurer

- 22% from a financial adviser

- 21% direct from their bank

- 4% via an online tool

The largest barrier to insurance products for those who do not already have them is the cost (35%), a belief that insurers don’t have their customers’ best interests at heart (13%) and a lack of trust in insurer.

The key reasons for working with a financial adviser, according to the survey, include wanting to “get a good deal” (32%), needing help to make a good decision (29%), and help with managing their finances (27%).

The FMA report shows financial advisers to be the second most trusted source of financial advice for most Kiwis (52%) and, says Financial Advice NZ CEO Katrina Shanks, backs up research commissioned by her organisation.

“That research, Trust in Advice, which was undertaken in 2020, showed 94% of those surveyed who had used an adviser rated them as good or very good with regard to trustworthiness,” she says.

“Both surveys show consumers across all demographics rate professional advisers very highly for their trustworthiness, good consumer outcomes, service, and results by consumers across all demographics.”

The survey also showed of all the advice sources people accessed, social media was the least trusted, although younger people trust it more than older people.

“That is something the industry needs to focus on as young people have less financial literacy,” says Shanks.

The survey also showed that while 65% of those surveyed feel confident in their financial decisions, just half (48%) are comfortable with their financial position.

Complaints

The FMA survey also shows only a third of people would feel confident in knowing what steps to take if they experienced unfair treatment from a financial services provider.

Of the five per cent of New Zealanders who have made a complaint about a financial services provider, just over half (56%) felt it was resolved to their satisfaction.

“We found an additional seven per cent (above the 5% who complained) would have liked to make a complaint but didn’t, meaning more than one in ten customers were considering a complaint of some kind,” says Barrass.

“Those who decided against making a complaint felt the process was either pointless or too difficult.

“A separate finding helps to explain this – only 31% of people are confident in knowing what to do if they experienced unfair treatment. This is an area I want to pay much closer attention to.”