Word of mouth is one of the most common ways for people to find service businesses, and insurance advice is no different, says a new report published by Asteron Life.

Based on the results of a survey it carried out, the report’s authors say that when thinking about why they started using an adviser, 29% of consumers point to the recommendation of someone they know.

Accountants or other business advisers encouraged 13% to think about engaging an adviser, while 10% of those surveyed said the experience of others was influential on their decision to seek professional financial advice.

This, states the report, suggests advisers could think about developing referral strategies to encourage current customers to recommend them to family and friends, especially those who have experienced help from an adviser during an insurance event.

“Additionally, other professional advisers, such as accountants and solicitors, can be valuable referral partners,” states the 27-page Asteron Life Insurance Index 2022 report.

Based on survey responses, it states that developing a referral strategy is made easier by the fact that almost 3 in 5 advised customers say they are “…willing to recommend their adviser to others”.

“Given the willingness of customers to provide recommendations, sometimes just simply asking satisfied customers to provide recommendations can be highly effective,” it states.

Other findings of the survey are that there is a significant lack of understanding of IP, TPD and Trauma cover, even among those who have the cover.

The report also found a strong correlation between levels of engagement and satisfaction, with 70% of those surveyed who have a collaborative relationship with their adviser being satisfied, compared to only 29% of those who aren’t in contact with their adviser.

In addition, 47% of advised respondents were satisfied with their last claim compared to 23% of non-advised. This, states the report, demonstrates the value of advisers to clients.

…47% of advised respondents were satisfied with their last claim compared to 23% of non-advised…

“Advised clients obviously appreciate the help they receive at claims time, so this benefit could be communicated as part of the sales process with prospective clients,” state the report’s authors.

“We can also see that clients value advisers who take the time to understand their individual needs and then deliver personalised service throughout the decision-making process. To keep satisfaction levels high, advisers could implement a continual cycle of engagement, not just a one-touch approach.

“Advisers can benefit from demonstrating their expertise by providing regular, relevant information and in-depth analysis and explanations for their recommendations.”

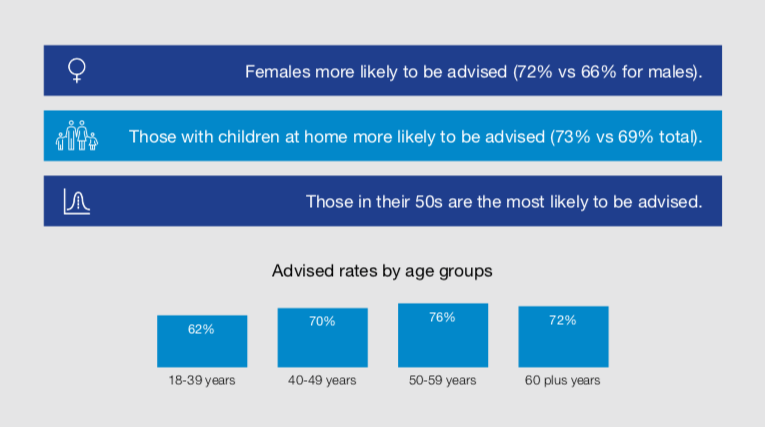

The report also shows that 69% of life insurance policyholders receive some form of advice. However, a split between men and women is clear, with 72% of women willing to seek advice and 66% of men. Those aged 50 and older are the most likely to be advised at 76% (18-39-year-olds sit at 62%).

Around half of advised customers claim to be satisfied with their adviser, while just over 20% are dissatisfied, states the report. Those with a neutral feeling toward their adviser sits at 29%, and 22% are not satisfied.