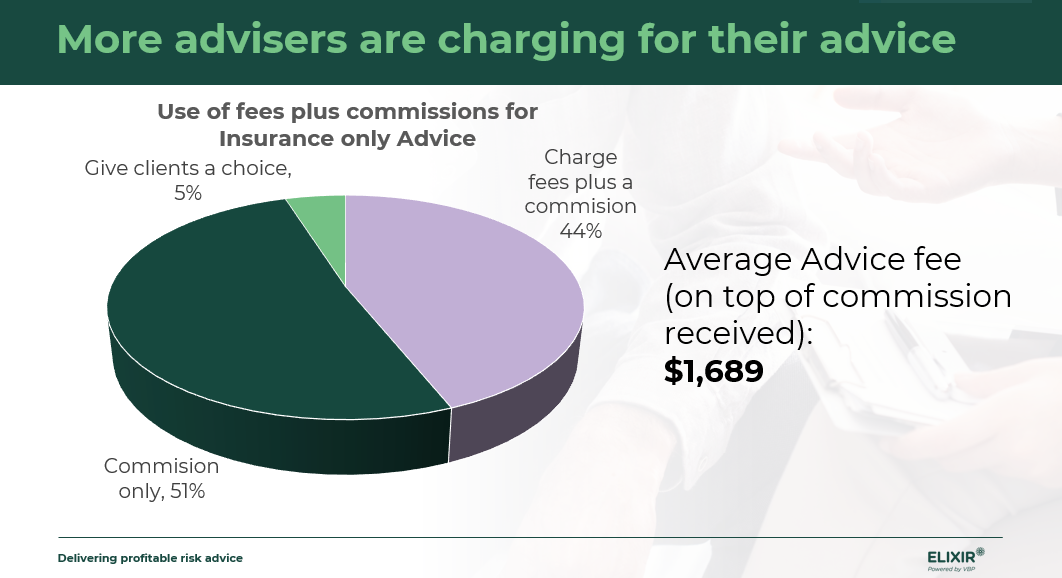

Almost half of insurance advisers in Australia are charging clients for risk advice. The finding is highlighted in a new industry survey that reveals 44% of those providing insurance-only advice are charging a fee on top of the product commissions they receive.

The figure, from Elixir Consulting’s latest practice management research study, reveals an increasing proportion of advisers across the ditch are charging for risk-only advice.

While more than half (51%) were found to still operate under a commission-only hybrid structure of 60% upfront and 20% ongoing, 5% of advisers offer clients a choice between fees and commissions. Of the 44% charging a combination of fees and commissions – when risk-only advice is delivered – Elixir reveals the average fee amount is AU$1,689 ($1,841).

Authors of the study also say ‘advice’ is an adviser’s intellectual property, which has inherent value for the client and is backed by the adviser’s knowledge and expertise.

Clients should pay for that advice, says Elixir, which it separates from the implementation work necessary to set up the agreed insurance solutions. It says the cost of the implementation work is built into the product and paid for by the life company in the form of a commission.

However, Elixir highlights a cautionary finding. Of the 171 advice firms it surveyed, just over a quarter (26%) only service the life insurance needs of existing clients when they ask for it.