Data published by business information and trends forecaster IBIS World shows New Zealand’s life insurers experienced a drop in annual revenue during the 2019 to 2024 period of 3.3% to $3.8bn. The trend is in contrast to the health insurance market, which saw annual revenue jump 9.4% over the same period to $2.6bn.

While not specifying dollar amounts, IBIS states profit for the country’s life insurance sector dropped 5.5% in the five years to 2024. However, the firm does provide 2024 revenue estimates for three firms:

- Resolution Life: $826.1m (trending up)

- AIA: $787m (trending down)

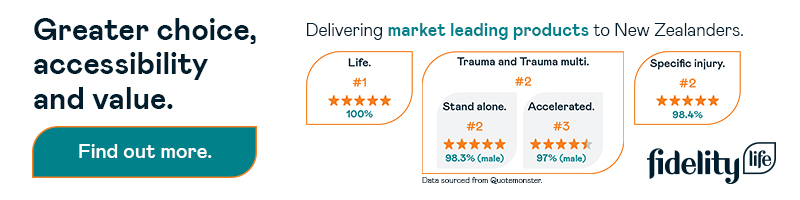

- Fidelity Life: $591.1m (trending up)

The report states there are 28 businesses selling life insurance in New Zealand and that revenue for the sector has taken a downward turn for most of them due to lapsed and cancelled policies outweighing new business.

Health insurance

It’s a different story for the health sector in New Zealand, which IBIS states is made up of 29 businesses. Since 2019 these firms have collectively seen increased revenue leading to a 16.4% rise in profits.

Researchers at IBIS state the country’s health insurance industry has recorded moderate growth, supported by rising premiums.

“Health insurance companies have reported an increasing volume of claims paid as the population aged 50 and over has risen,” states IBIS. “This expanding demand for coverage has been coupled with repeated price hikes.

From which of these advice streams would you expect to generate more business over the next 12 months

- Health insurance (41%)

- About 50-50 (30%)

- Life insurance (23%)

- Not sure (6%)

“Recent inflationary trends have allowed insurers to lift their premiums, helping them maintain healthier profitability.”

IBIS states that a “decent percentage” of New Zealanders view health insurance as a necessity, giving insurers more power to raise costs without losing their key targeted policyholders.

“Health consciousness among the population has become more intense, supporting health insurance coverage,” states IBIS. “A rise in employer-subsidised memberships has also driven increasing coverage rates.”

The research firm sates market share concentration for the health insurance industry in New Zealand is high, “…which means the top four companies generate more than 70% of industry revenue”.

IBIS predicts the health insurance market to grow over the next five years, while it expects the life insurance market to decline.