This week, strong reader interest was sparked by comments from a leading economist highlighting what he sees as significant life insurance affordability challenges…

While there remains a growing need for life insurance in New Zealand, a key economist says there are critical affordability pressures at play, noting the average Kiwi cannot afford the insurance industry’s products and services.

This was one of a number of key points made by economist Shamubeel Eaqub during a well-attended masterclass on life and health insurance at this month’s FSC annual conference held in Auckland.

Eaqub outlined the economic context for life insurance, the changing demographics of both the population and of households, and the financial pressures New Zealanders are under – all aspects, he says, insurers and advisers need to consider for the future.

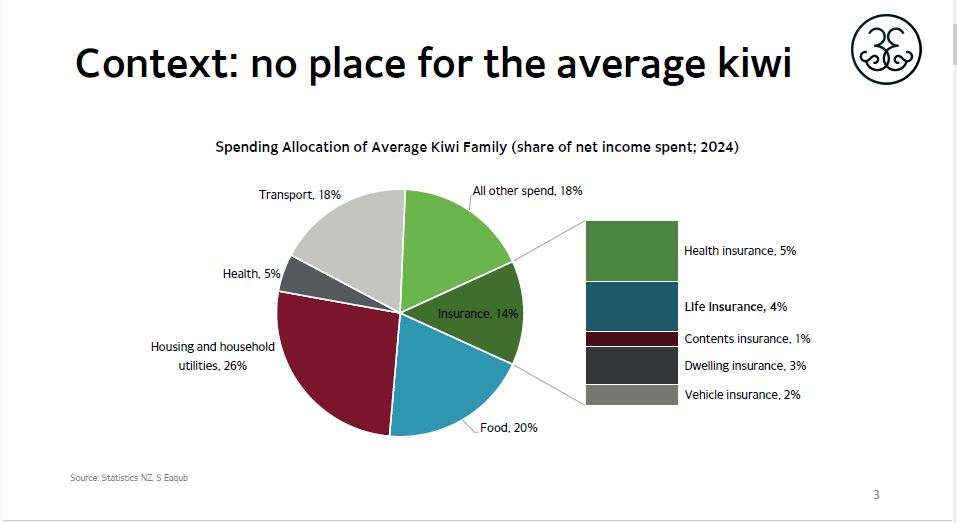

To illustrate his point, he presented a chart detailing the spending allocation of the average Kiwi family, which revealed insurance takes 14% of total income. This compared with 20% spent on food, and 26% on housing and household utilities.

The insurance component included health, life, contents, dwelling and vehicle insurance. Of this, life insurance took 4% of income. However, only 29% of households have life insurance, according to Eaqub.

Pointing to the changing market and demographics in New Zealand, he painted a picture of falling home ownership rates, with households squeezed as they take on large mortgages. In 1994 it took 13 years to pay off a mortgage. In 2024 it takes 60 years.

Of average households today:

- One third own houses with no mortgage

- One third own houses with a mortgage (137,000 of these households are “very stressed”)

- One third of households are renting (a third of these (233,000) rent without some form of subsidy

This, he says, tells him the life insurance market is shrinking with bill-payers stuck with recurring high needs.

A recent FSC survey of life insurance found the prime age group for life insurance is those aged in their 30s to late 50s.

…You need to get [clients] earlier and keep them longer…

“But the share of New Zealanders aged 15 to 64 is at its peak…It will fall in the foreseeable future. You need to get [clients] earlier, and keep them longer.”

And with more people living longer “…how do we live that longer life, better?”

In analysing Rotorua’s population, Eaqub says much of the region’s growth is due to migration, but questioned how easy is it for new migrants to buy life insurance.

He said life insurance products have to keep up with the changes in both the ethnic mix of the country and with household demographics – the fastest growing household group is families with adult children at home. Does the industry have the right product for this family group?

As to whether it’s easy to make the right decisions when buying life insurance, his personal experience is that it is not – people should be able to make comparisons with ease.

Eaqub asked the audience what their customers truly want, noting the reality of what the industry does, is very important. It creates real value for people “…but need is not the same as want.”

“The story of value has to be told a lot better, the value we create is seen as negative.”

…There are plenty of opportunities because the need is not going away…

As for the strategic outlook, Eaqub says there are more customers, but they have very different wants and needs, reiterating that affordability is a big issue with the average New Zealander unable to afford life insurance.

He said the industry needs to target the middle part of the population, not just the top.

“There are plenty of opportunities because the need is not going away,” he says.

How do you become an industry that is responsive to the rate of change that is coming, he asked.

The two-hour masterclass was facilitated by Mark Banicevich, Head of Industry Engagement, Partners Life with the other speakers and panellists comprising:

- Bronwyn Kirwan – Chief Commercial Officer, Fidelity Life

- Mark McClenahan – Head of Life & Health for NZ and Head of Product & Pricing, Aus & NZ, Swiss Re

- Nick Kirwan – Independent Insurance Consultant

- Steve Wright – Independent Advice Coach