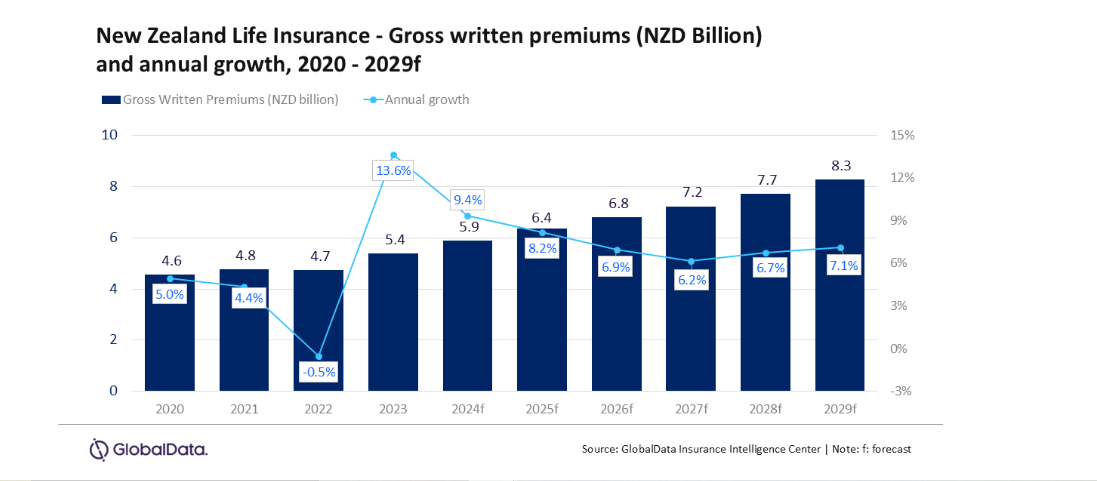

The life insurance market in New Zealand is projected to grow from NZ$5.9 billion in 2024 to NZ$8.3 billion in 2029, registering a compound annual growth rate of 7.0%, in terms of gross written premium, according to GlobalData, a major data and analytics company.

It says this is driven by increasing demand for whole life and personal accident and health (PA&H) insurance, as well as a growing awareness of protection policies.

The company says its insurance database indicates that the New Zealand life insurance market is expected to reach NZ$6.4 billion in gross written premiums in 2025, registering an 8.2% annual growth.

“Factors fuelling this growth include an aging population, heightened health awareness, and the rising cost of living, which have increased the need for financial protection.”

GlobalData says New Zealand’s economy is projected to rebound with a real GDP growth rate of 2% in 2025, compared to 0.73% in 2023 and 0.24% in 2024.

Swarup Kumar Sahoo, Senior Insurance Analyst at GlobalData, says economic recovery, coupled with easing inflation and increased private investment “…will support household consumption and drive demand for life insurance products. However, challenges such as high unemployment and inflation could pose risks to this growth.”

…life personal accident and health insurance represents the largest line of business in the New Zealand life insurance industry…

The company says life personal accident and health (PA&H) insurance represents the largest line of business in the New Zealand life insurance industry, accounting for 65.3% of the life insurance GWP in 2024.

“It is expected to grow at a CAGR of 6.9% over 2025-29, driven by rising healthcare expenditure and a resultant 10%-15% increase in premium prices in 2024.

“According to the Financial Services Council the percentage of New Zealanders with health insurance rose from 32% in 2022 to 37% in 2023, indicating a higher uptake of health policy due to growing concern regarding access to quality healthcare.”

It says term life insurance, which holds a 27.8% share of the life insurance GWP in 2024, is projected to grow at a CAGR of 6.4% during 2025–2029.

Sahoo adds that term life policies are favoured for their affordability “…and are popular for covering mortgages and personal loans. As a result, despite economic challenges, term life insurance remains resilient.”

…Whole-life insurance, the third-largest line of business, accounted for only 3.8% of the total life insurance GWP in 2024…

Whole-life insurance, the third-largest line of business, accounted for only 3.8% of the total life insurance GWP in 2024.

“However, it recorded an impressive CAGR of 19.2% during 2020-24 and is estimated to grow at a CAGR of 8.0% over 2025-29.”

GlobalData says that according to Stats NZ, the population over 65 years old is projected to reach 1.3 million by 2040, which will drive the demand for whole-life insurance products in the country. Also, life expectancy at birth has increased from 81.6 years in 2015 to 82.9 years in 2024.

“Other life insurance products are expected to make up the remaining 3.1% share of the life insurance GWP in 2024.”

Lower life insurance penetration in NZ

Sahoo concludes that “…the lower life insurance penetration rate in New Zealand (1.3%) in 2023 compared to other APAC peers such as South Korea (7.4%), Hong Kong (China SAR) (15.9%), Japan (6.3%), and Singapore (7.5%) provides ample growth opportunity to insurers.”

However, he says the rising cost of living will result in under-insurance and hinder the growth of the life insurance market.

“To address this issue, insurers need to introduce innovative products and leverage digital technologies to make insurance more affordable and accessible.”