The Australian Federal Government has released the implementation program it has developed for the 76 recommendations stemming from the Banking Royal Commission.

The implementation program is split into three main sections which require action variously from:

- The Federal Government (Appendix A)

- The Government regulators, APRA and ASIC (Appendix B)

- Industry associations and organisations (Appendix C)

There has been little change to the Government’s intentions when it comes to a number of the Banking Royal Commission recommendations that impact financial advisers and advice businesses. Re-stated within the Government’s implementation roadmap, these critical recommendations include:

Recommendation 2.4 (banning grandfathered investment and superannuation commissions)

Legislation ending grandfathered commissions for financial advisers was introduced into Parliament on 1 August 2019 (see: Government Confirms Grandfathering Ban Date).

Recommendation 2.5 (the future treatment of life risk commissions)

Covered under Appendix B – for action by the regulators, the Government has reaffirmed that ASIC will include the factors identified by the Royal Commission in undertaking its post implementation review of the 2017 Life Insurance Framework reforms (see: Royal Commission Casts Doubt on Future of Risk Commissions). ASIC’s review is set to take place in 2021.

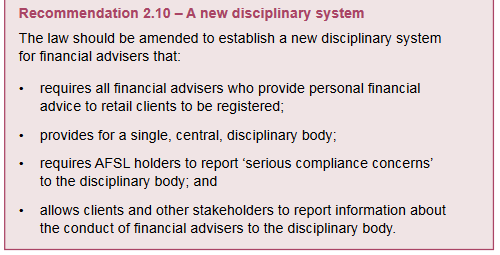

Recommendation 2.10 (a new disciplinary system)

Under an agenda of enhancing accountability, the Government has confirmed it will implement Banking Royal Commission recommendation 2.10, which calls for the establishment of a new disciplinary system for financial advisers. Taken directly from the final report of the Banking Royal Commission, recommendation 2.10 reads:

Banking Royal Commission Recommendation 2.10

In confirming the establishment of the new disciplinary system for advisers, the Government has noted that in relation to Commissioner Hayne’s recommendation 2.10 ‘…builds on the Government’s professional standards reforms to raise the educational, training and ethical standards of financial advisers [via FASEA].’

The Government notes it will proceed with monitoring of the Code of Ethics introduced as part of those reforms, which will require all financial advisers to subscribe to a code monitoring body from 15 November 2019, which will enforce the Code of Ethics from 1 January 2020 (see: Joint Code Monitoring Proposition).

In the various statements accompanying the release of the Government’s Banking Royal Commission implementation roadmap, and reinforced by Treasurer Josh Frydenberg at the formal announcement of the program at an industry event in Melbourne, the Treasurer has given a perspective to the scope of these reforms, characterising them as the largest and most comprehensive corporate and financial services law reform package in three decades.

Advisers can click here to access the full details included in the Governments Banking Royal Commission reform agenda implementation roadmap, presented under the theme of Restoring Trust in Australia’s Financial System.