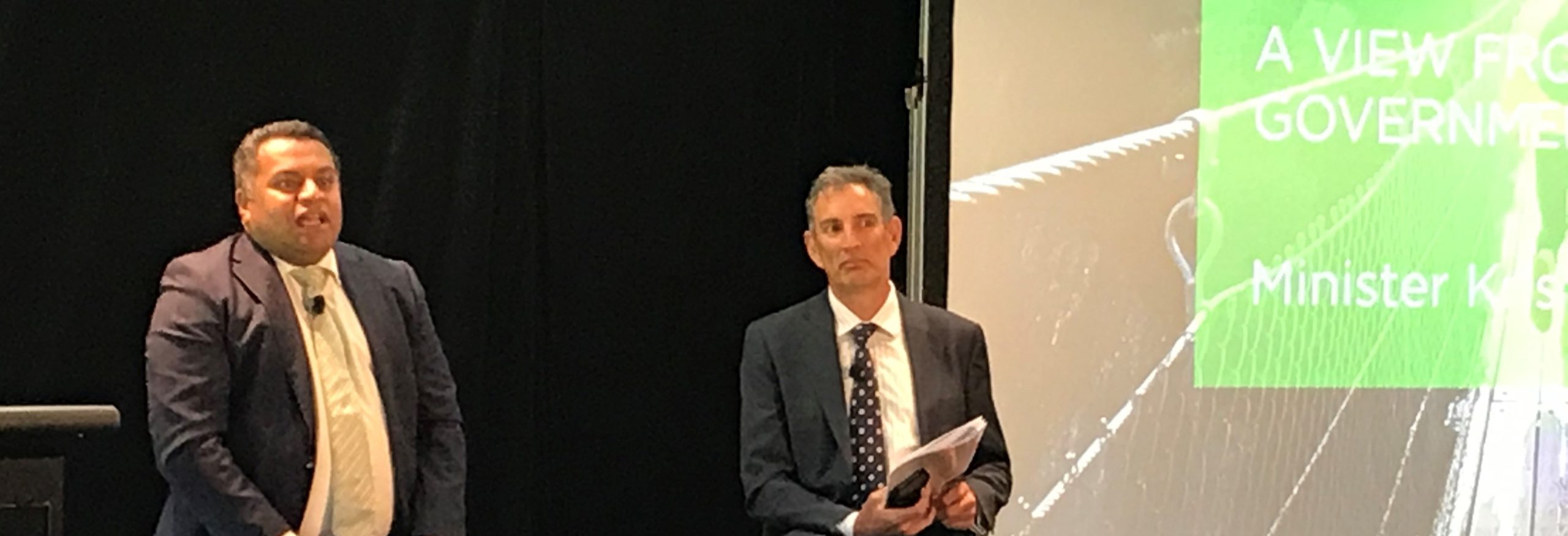

Commerce Minister, Kris Faafoi, has shared a personal experience with advisers which underpins his support for the value of life insurance advice, as the industry continues its regulatory evolution.

Addressing 260+ advisers and other attendees in Wellington at the first of the FSC ‘s ‘Get in Shape Advice Summit 2020’ roadshow events this week, the Minister noted he felt the advice sector is coming to the end of a period of hard grind, pending the implementation of the transitional adviser licensing requirements taking effect from 29th June 2020.

…the advice sector is coming to the end of a period of hard grind

Lending a personal perspective to his reform agenda, the Minister related with his audience the fact of his father’s passing at the age of 63 – with no life insurance – a circumstance the Minister said he had no wish to repeat.

Noting he was fortunate today to have the means to protect his own family, the Minister referenced his sad experience earlier in his life as an example of what motivates him in his drive to see all New Zealanders, especially the most vulnerable in the community, have access to affordable financial advice which reflects their best interests.

Addressing the adviser licensing, conduct and disclosure reforms which will significantly and permanently change the NZ advice landscape, the Minister noted the totality of these reforms were ultimately intended to achieve greater consumer confidence in the financial advice sector, and to deliver more positive financial outcomes for New Zealanders.

While the Minister was at pains to emphasise he had no agenda to introduce any further changes to those already flagged or mandated, he noted (subject to the outcome of the 19 September 2020 election) his re-elected Government would devote more effort to addressing the broader issue of consumer financial literacy.

The Minister told advisers he would also address consumer contract law as it relates to structuring a future system which did not penalise an insured life for claiming on an event which was entirely unrelated to other medical events or issues that the proposed life unintentionally failed to disclose.

RiskinfoNZ will report other key take-outs from this current FSC/Financial Advice NZ ‘Get in Shape 2020’ roadshow series, in conjunction with MBIE and the FMA, which will also be visiting Auckland, Christchurch and Dunedin…