The life insurance industry’s performance in Australia continues to worsen, partly driven by the poor performance of risk business, says APRA in releasing its Quarterly Life Insurance Performance Statistics publication for the March 2020 quarter.

A statement from APRA says the life industry’s net loss after tax was $1.8 billion for the year to March 2020, “a significant reduction from $759 million profit in the previous year”.

“This deterioration was caused by poor results in both the December and March quarters, driven by the poor performance of risk business and a substantial collapse in investment revenue owing to the Covid-19 related volatility in investment markets. This was somewhat offset by the release of reserves, which fell by 78.1 percent in the 12 months to March 2020.”

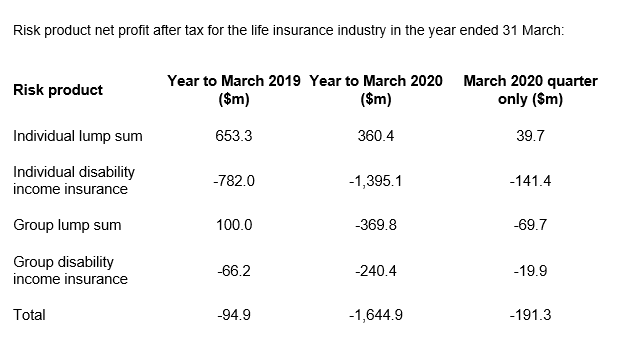

APRA stated that for the 12 months to March 2020, risk products reported a combined after-tax loss of $1.6 billion.

“All risk products deteriorated with the only exception being the Individual Lump Sum product. In particular, Individual Disability Income Insurance (also known as Income Protection Insurance) reported a substantial loss, primarily driven by loss recognition as adverse claims experience persists,” the regulator says.

The publication provides industry aggregate summaries of financial performance, financial position, capital adequacy and key ratios and is available here.