There’s a world of opportunity for financial advisers when it comes to life insurance in New Zealand with a Swiss Re Institute study estimating the amount of under-insurance totalling US$435 billion (NZ$620 billion).

Its consumer survey found that 64% of households are under-protected and about a fifth have just 10% or less of the financial resources to cover their protection needs.

The firm’s report, Closing New Zealand’s Mortality Protection Gap, concludes that most households are aware of the financial risk associated with mortality – but are more concerned with health and disability protection than life cover.

“Our research estimates that most New Zealand households are vulnerable to financial hardship in the event of the premature death of a primary earner,” says the report’s authors.

“The most exposed are households with young earners, which have the highest protection need given the longer periods of dependency still outstanding.

“Low life insurance penetration and fewer accumulated savings are major factors driving the shortfall among high-gap households.

“We estimate the total mortality protection gap (MPG) for New Zealand at US$435 billion, and anticipate that demographic trends may cause the gap to grow to about US$500 billion by 2030 if no action is taken.”

The report says consumers feel they have alternatives to life insurance to boost their financial security to protect against mortality risk. These include earning and investing more, drawing on support from family and friends, and using government schemes such as KiwiSaver, NZ Super, and the ACC.

“Close to a third of households overestimate their level of financial preparedness for a mortality shock,” says the report.

In order to close the gap in New Zealand, an additional US$1.5 billion of annual life insurance premiums would need to be paid by 2030.

“This would support New Zealanders in ensuring they are financially prepared for what the future may hold,” says Swiss Re Institute.

“We see an opportunity for insurers in New Zealand to improve awareness and understanding of life insurance by working with governments and industry bodies to educate families about their mortality protection gap,” say the report’s authors.

“Insurers are also encouraged to continue to improve the customisation and flexibility of their products, letting customers adapt their insurance to their families’ changing needs over time.

“However, this does result in a trade-off with complexity, so insurers need to communicate clearly with customers at every life stage.”

Young professionals

Key targets for financial advisers, says the report, are young and middle-aged professionals.

“This group has a significant protection gap,” says the report. “Designing products and directing communication, education and distribution to these groups should benefit these consumers in the medium to long term, and support a reduction in the protection gap.

“Young professionals have the highest average MPG, but tend to underestimate their protection needs. Insurers could reach this segment at the point of major life events such as buying a house, marriage or starting a family, which are typically triggers for buying (more) life insurance.”

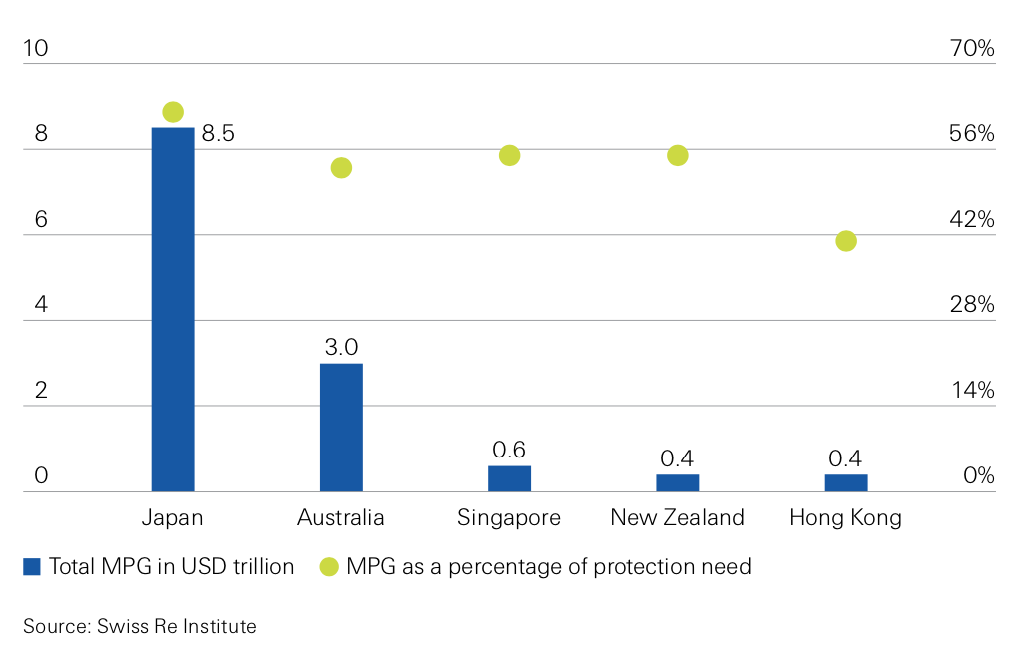

Swiss Re Institute estimates the MPG per household in New Zealand at more than US$540,000 (NZ$770,000), similar to Australia – but significantly higher than in most other advanced Asia Pacific markets, where household incomes are lower.

“New Zealand’s MPG as a percentage of protection need is around 55%, indicating that more than half of the average household’s financial need remains unprotected,” says the firm.

According to the report, almost two thirds of households in New Zealand have some degree of MPG, just 39% of consumers reported owning a life insurance policy, and buying life cover is not their default option for more security.

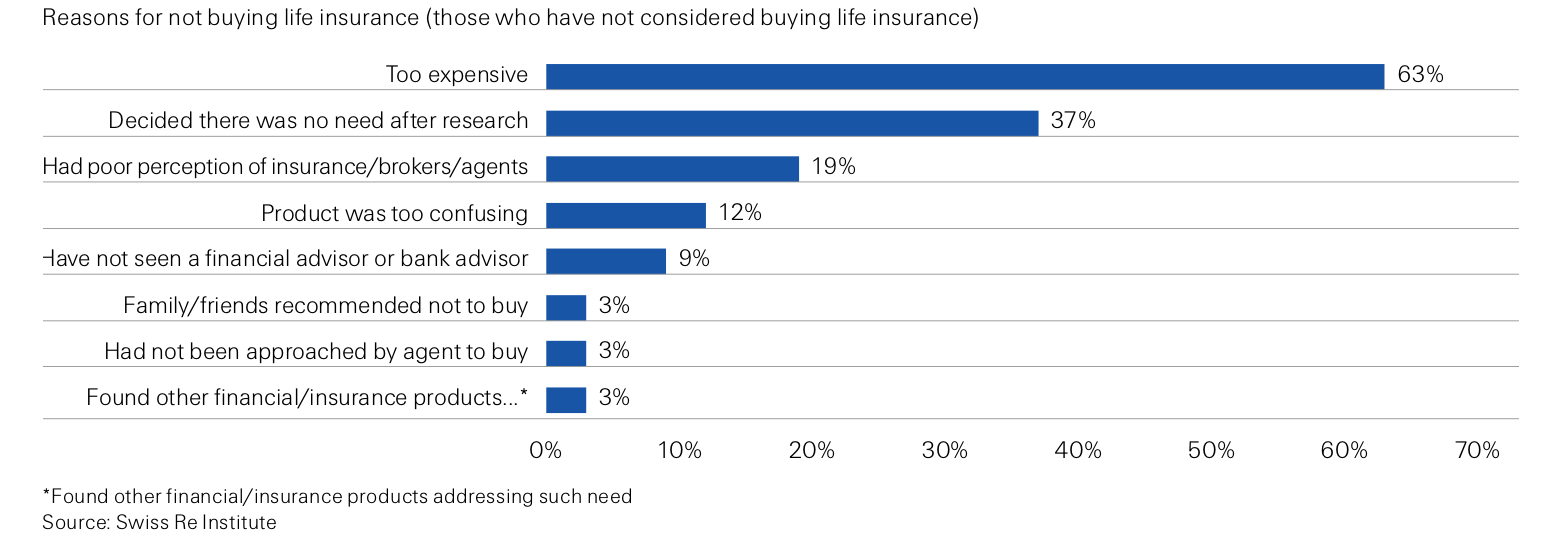

“Consumers choose not to buy life insurance for reasons including perceived high price, poor perceptions of financial advisers and brokers, and the complexity of the product.”

The report says premium levels, sums assured and the ease of making claims are major factors influencing consumers’ life insurance purchase decisions.

“Insurers could address cost concerns by offering products with flexible premium payment options and coverage terms…Insurers can also educate consumers about the benefits of life insurance cover with transparent communication and easy-to-understand products.”