In Australia Adviser Ratings forecasts there will be 16,500 advisers for the start of 2022 after FASEA’s exam regulation comes into play, a drop of 20% year-on-year.

The company’s latest Adviser Musical Chairs Report, highlighting financial adviser and licensee movement for the third quarter of 2021, says that with the education standards deadline on the horizon, several thousand advisers will leave the industry in the next few years.

“In fact, we forecast there are still close to 5,000 advisers who will depart before numbers stabilise.”

Adviser Ratings told Riskinfo the 16,500 forecast for the start of 2022 comes from:

- The advisers remaining to still pass the FASEA exam by 31 December (offset by the estimated expectation of those who have failed twice – extension given to 30 September 2022). There is only one more exam left. We expect approx 2000 advisers that are no longer allowed to practice from 1 January (also based on current fail rates)

- Organic retirements already coming through especially those from limited licensees, and risk advisers continue to exit the industry at a rate of 2.5 to 1 greater than the average wealth adviser

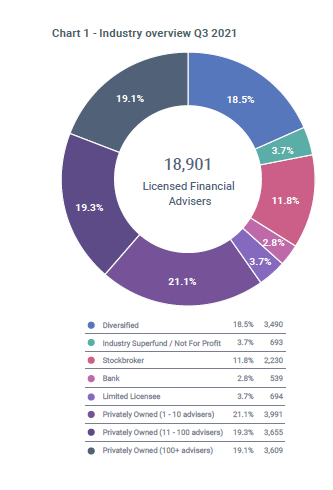

The report itself also notes that the adviser workforce has now dropped below the 19,000 mark, which is getting closer to the number of advisers who had sat the FASEA exam by September (19,000) and that around 9-in-10, or 16,850, have now passed their exam.

Nevertheless, it says, only 14,630 out of those were recorded as active financial advisers on ASIC’s FAR at that time.

Flight risk analysis

The report includes a special feature which shows that trends are beginning to emerge around the types of advisers who are choosing to depart, along with a ‘flight risk’ analysis.

The report says an adviser’s ‘flight risk’ is their likelihood to depart the industry in the next two years and that it’s an assessment based on a number of factors, including behaviour, qualifications, age and personal intentions.

…if looking at advisers who have already left the industry, more than half had a ‘high’ flight risk score…

Adviser Ratings says if looking at advisers who have already left the industry, more than half had a ‘high’ flight risk score, while a further two-in-five had a ‘moderate’ flight risk rating.

“Collectively, more than 90% of those who have left showed some early indications that they were on their way out,” the report states.

“When we turn our attention to current advisers, six percent – or roughly 1,100 advisers – have a ‘high’ flight risk. We are fairly confident these advisers will exit the industry in the next two years.”

Meanwhile, the report says a quarter of the remaining advisers – roughly 4,800 – are at ‘moderate’ risk of departure.

“These advisers have a higher propensity than the average adviser to depart the industry.”

It says that putting it all together, more than 30% of the current workforce “…is at least a moderate flight risk. In other words, almost a third of advisers (31.6%) are showing signs of potential departure.”

The report says that while Adviser Ratings doesn’t expect flight risk to translate into departure in all cases, “…these early indications should raise the alarm. With an impending mass exodus on the cards in the next two years and just a trickle of new talent, many Australians in need of financial advice will struggle to find it.”