A report pointing to the risk of higher insurance premiums and a rise in claims – as a result of ‘Long Covid’ – caught the attention of RiskinfoNZ readers this week…

The Actuaries Institute in Australia says there is a risk of higher insurance claims and premiums as a result of Long Covid – a condition some people suffer post Covid-19 infection. Common symptoms include fatigue, shortness of breath, and cognitive dysfunction.

In a research note for the institute, How Covid-19 has affected Mortality and Morbidity in 2020 & 2021, authors Jennifer Lang, Richard Lyon and Karen Cutter report on the global picture taking in data from 37 countries – including New Zealand.

In examining Long Covid the authors anticipate “…higher insurance claims and potentially higher premiums for all disability-related insurance – including income protection, workers’ compensation and Group Total and Permanent Disability”.

The report found New Zealand recorded fewer doctor-certified deaths than expected during 2020 and 2021, despite the impact of Covid, with measures such as border closures, face masks and social distancing likely reducing the number of lives lost.

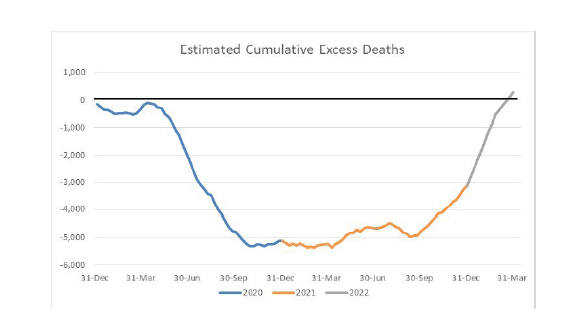

It also says New Zealand experienced zero excess mortality to the end of 2021 and that for the 2020 and 2021 years combined, 2,797 fewer people died than predicted.

Their data shows 5.7 million excess deaths over the 2020/21 years (up 17%) across 37 countries. Its excess death table ranges from -4% (New Zealand) to +84% (Peru).

The Institute says its “excess mortality” model measures actual deaths against predicted deaths, in total and across each cause of death and age band. The prediction allows for changes in the size and age of the population and for trends in mortality improvement.

It says the 2021 analysis by age band revealed surprising results including significantly lower deaths in the 45-64 age band, significantly higher in the 75-84 age band, and close to expected in the 85+ band.

“Perhaps the differences between the two oldest age bands are due to higher levels of protection in aged care homes, home care and hospitals than in the general community, possibly leading to much fewer-than-expected deaths from respiratory disease,” the report says.

The report’s authors say Long Covid will require:

- Better health care for long term illness, such as investment in more health care workers, long Covid clinics, and other supports in the health care system

- Income support for those unable to work, or who have reduced ability to work, due to long Covid

- Support in the workplace to enable affected workers to continue working while suffering long Covid symptoms

However, Lang adds that it is too early to say what the long-term impact will be, “…but we need to be ready. There are more people who are long-term disabled than there were before Covid”.

Actuaries Institute President Annette King says the Covid mortality working group, and actuaries broadly, have provided unique insights into the pandemic.

“Actuaries use their skills to advise on a wide range of current issues and public policy,” she says. “During the pandemic, they looked at the patterns of data to help policymakers and the public understand the impact of this unprecedented public health crisis.”