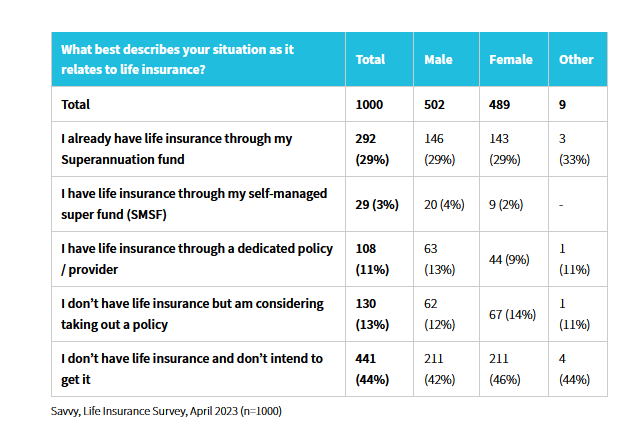

A “staggering” 44% of Australians don’t have life insurance – and have no plans to take out a policy – according to cost-of-living survey by Savvy.

The financial broking firm says its Life Insurance Survey 2023 found 46% of women and 42% of men in Australia don’t have – and don’t want – life insurance.

“That leaves a little under a third with basic life insurance provided through their superannuation fund (33%) and only 11% who have taken out a life insurance policy through a dedicated provider,” the company states.

It also notes that 13% of those surveyed don’t have life insurance as of yet but are considering buying a policy.

Savvy also points to the Financial Services Council Australia’s Life Underinsurance Gap: Research Report, which says there are an estimated one million Australians underinsured for death/Total & Permanent Disability and about 3.4 million underinsured for income protection insurance.

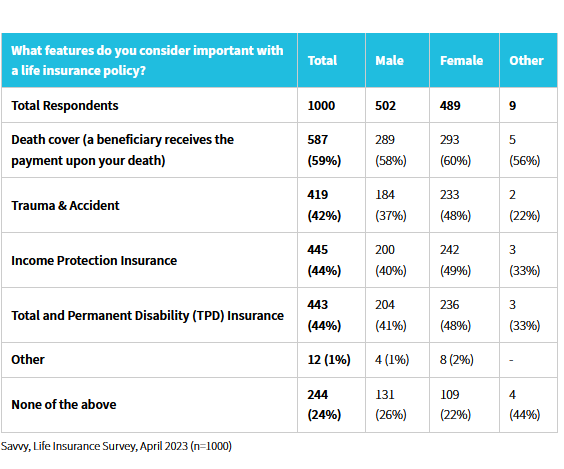

What people value with life insurance

As far as what life insurance policies should cover, Savvy states that 59% of Australians agree that it should cover death with 67% of 35-44 year olds citing it as the most important component of a life insurance policy.

However it notes 42% said that trauma and accident cover is important “…with 44% of respondents agreeing that income protection insurance and TPD insurance are important features. 48% of women said that trauma and accident insurance is important, compared with 37% of men.”

Adrian Edlington, spokesperson for Savvy, says the fact that so many Australians seem to understand the value of life insurance “…yet don’t have a policy is alarming”.