Insurers and the medical profession in Australia are being called on to inject greater efficiencies into the life insurance claims process.

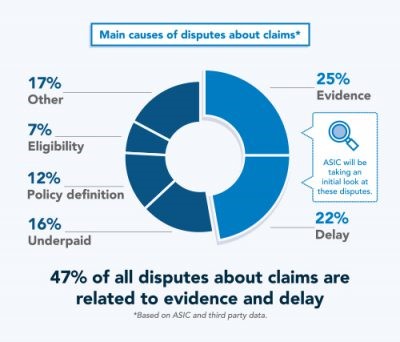

This call is being made by new services provider, TPD Claim Support, which says 47% of all claims disputes across The Ditch are generated by issues associated with evidence and delays (see chart below).

Lack of clarity

TPD Claim Support co-founder, Trevor Battersby, told Riskinfo many claims disputes can stem from a lack of detail and clarity in the reports written by general practitioners and medical specialists that are submitted in support of their patient’s claim. He says many such claim submissions are either denied or further information is requested because of this lack of clear or unequivocal evidence contained in the initial medical reports provided to the claims officer.

Battersby says the medical profession should be better educated when it comes to understanding exactly what evidence is being sought in the reports being requested by life company claims teams, where unclear and ambiguous statements contained in the reports create delays which might otherwise be avoidable.

Delays

Even more frustrating, according to Battersby, is the long turnaround times often taken by medical professionals to return the requested reports: “We often see three-to-six months pass – sometimes more – and the stress that clients are feeling due to their medical condition is often made worse when combined with the lack of income coming into the household. It really makes it that much harder for advisers on the frontline to secure a good outcome for their clients.”

Battersby also asks where the accountability should rest for genuine cases where claimants are suffering financially, not just medically, under circumstances where medical professionals delay the provision of the reports that are vital for insurers to assess the validity of the claim.

Capacity issues

Further exacerbating the delays and the lack of thorough and precise medical reporting is a system which is struggling with capacity, according to Battersby, who says the volume of TPD and other claims submitted during and post the Covid-19 pandemic has placed even greater pressure on the ability of life company claim teams to consider and make determinations on claims in a reasonable timeframe.

…planners, practices and back office support teams just don’t have the capacity to manage this process anymore

He says the issue of capacity also extends to individual advice practices: “From what we are seeing, planners, practices and back office support teams just don’t have the capacity to manage this process anymore,” says Battersby, who also notes that with the exit of so many experienced risk advisers from the industry there seems to be an increase in sub-standard applications submitted by those advisers less experienced with the claims process:

“With 10,000 plus advisers less in general, the profession is struggling with capacity. It’s a major issue. So many advisers and advice practices just don’t have the time these days to dedicate 40-240 hours on a claim.” Battersby says this capacity concern at the advice practice level can also contribute to delays in the claims process, which he says can significantly benefit from much greater education and collaboration between all linked stakeholders which include the insurer, the adviser, the claimant and their GP and specialist medical providers:

“Absolutely key to reducing claims disputes is the need for higher application accuracy with strong research and supporting evidence, far greater diligence in managing the claims process and all the many touch points in that process including the medical community,” urged Battersby.