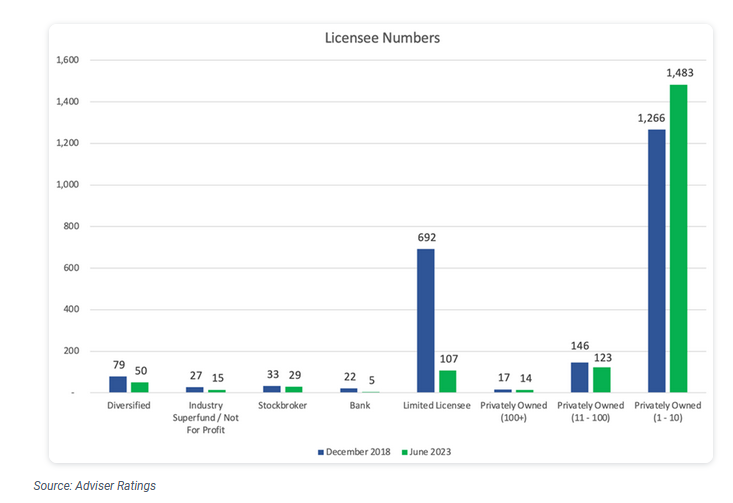

Small licensee numbers are surging as Australia’s financial services landscape continues its evolution, according to the latest research from Adviser Ratings, which points to a 17% increase in small licensees (1-10 advisers) since 2018.

It says this rise is reshaping advisory services “…leading to diversified, specialised offerings and posing essential inquiries into implications for advisers’ choices and the transformation of the financial advisory framework.”

Adviser Ratings also notes the surge of small licensees means this is the only Australian Financial Services Licence (AFSL) segment that has grown as numbers have declined from a high of 2,282 at the end of 2018 to 1,826 today.

In asking what the implications are for advisers and the financial advisory landscape, the research firms poses two scenarios, firstly pointing to one adviser who, in 2021, decided to close his AFSL and join a larger group.

It notes that conversely however, hundreds of advisers were opening their own AFSLs and going self-licensed “…with advisers preferencing self-licensing to mid-tier licensees and dealer groups as banks have exited and AMP and Insignia have cut their numbers.”