Our report featuring new data showing a significant growth in trauma premiums in the 12 months to September drew strong reader interest this week…

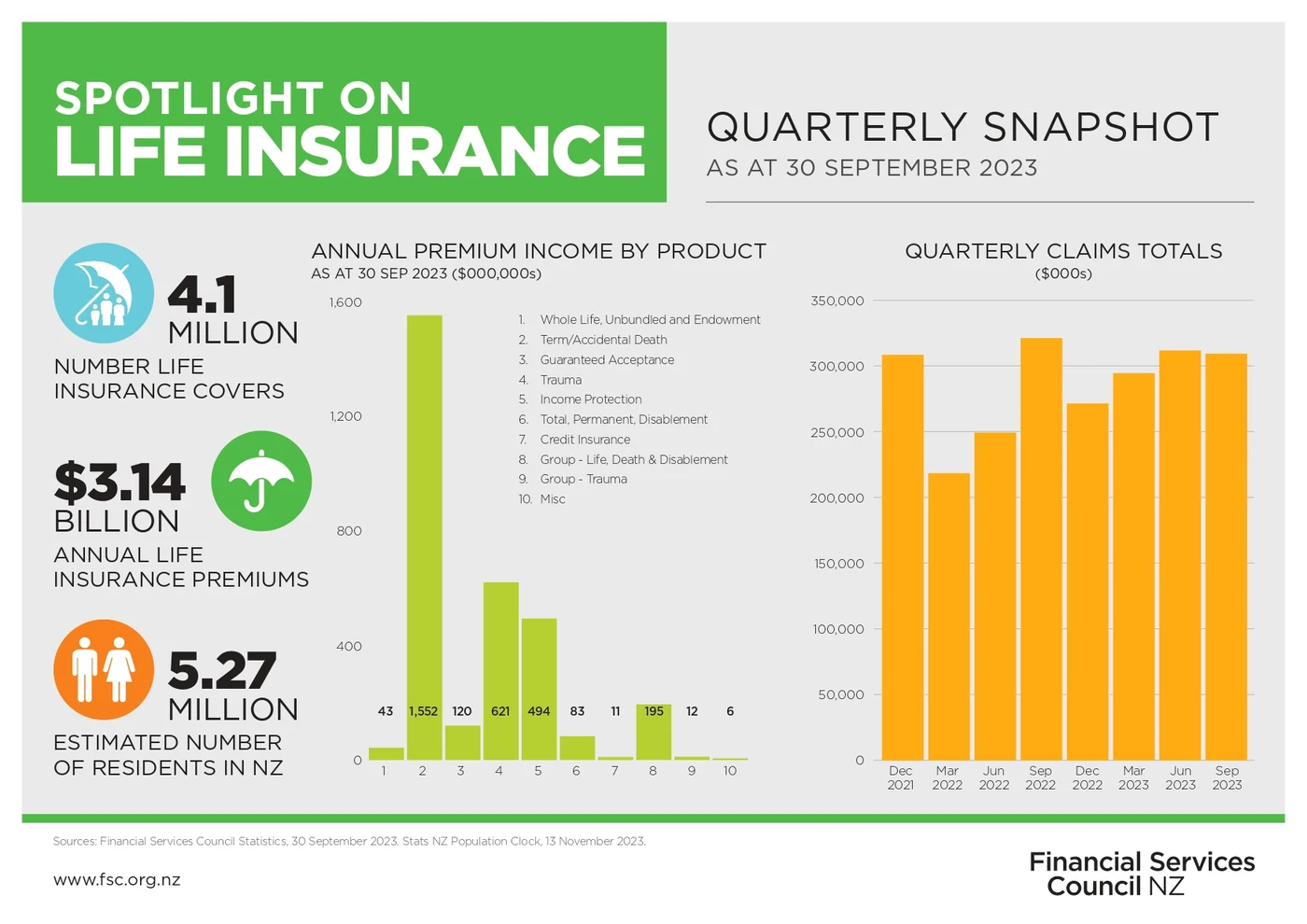

Just published data from the FSC shows there has been significant growth in trauma premiums, making it the second product after term/accidental death cover for insurers.

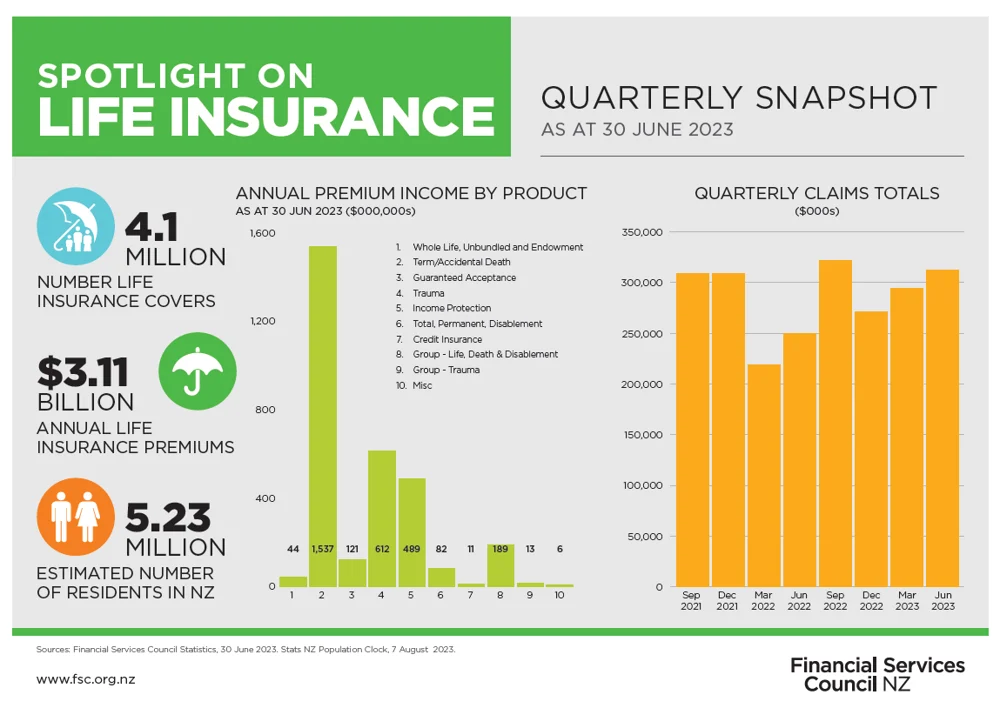

The FSC states that trauma products delivered annual premiums of $621m as at the 12 months to September 2023, up from the 12 months to June 2023 when it was $612m.

In all, there are 4.1 million risk insurance covers in place, delivering annual premiums of $3.14bn. Quarterly claims figures are returning to industry norms following a clear dip in numbers that appeared in the March 2022 quarter.

In terms of channel split – how business is placed with insurers – there has been little change since the FSC began publishing data in 2020. With 60% coming from advisers, more than 20% from banks, and the rest spit between direct and group.

The FSC states that the number of covers from group share of the total has increased, taking over from those coming from banks. Although figures are not shared by the organisation.

By gender, 60% of males have cover, compared to 30% females (10% unknown). New Zealand currently has a population of 5.27 million.

Date for 30 June 2023