Radar Results Principal, John Birt, says that prices offered for financial planning and risk books have declined in Australia.

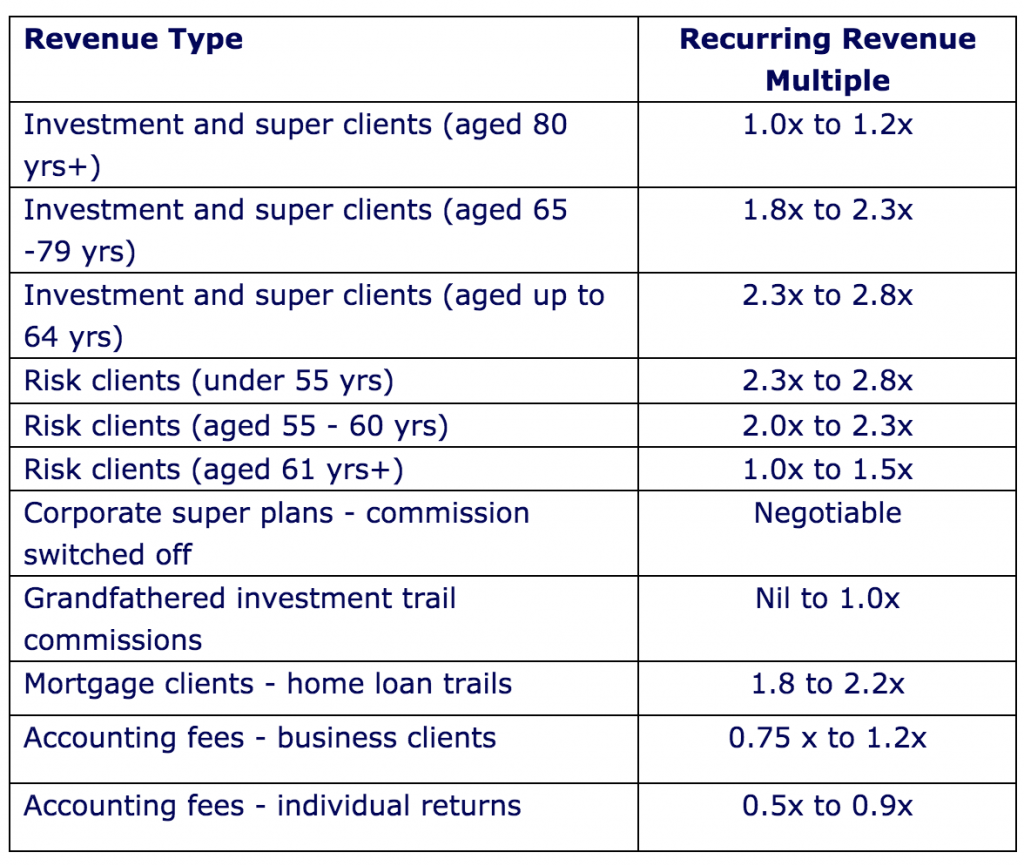

A summary of over 130 financial planning practices and client registers were prepared through Radar Results marketing and shows they are looking to sell for price multiples ranging from 1.0x to 2.8x the recurring revenue (RR), with these multiples applying to practices where the annual revenue is up to $1 million.

Birt said that based on acquisitions made by clients of Radar Results over the past 13 years, risk insurance portfolios proved to be most popular, followed by registers of accumulator investment clients.

“Today buyers are more cautious, and if they are going to pay up to 2.8x RR for a business, then the business needs to perform.”

“Today buyers are more cautious, and if they are going to pay up to 2.8x RR for a business, then the business needs to perform,” he said.

Commenting on the below revised Price Guide based on sales since Feb 2019 when the Royal Commission Report was released, Birt said prices offered for financial planning and risk books have definitely fallen.

“Some lenders have lowered their lending loan to value ratio (LVR) and will not provide funding for any part of a business or register that exceeds 2.5x RR. The lenders are now asking for more equity or cash to be included in the finance deal,” he said.

Birt noted that multiples paid for risk books or insurance revenue-based practices will vary depending on the client’s occupation, size of premium, type of policy (stepped or level) and geographic location of the client.