Treating clients fairly, providing suitable advice, and ensuring they understand the agreement they are signing, were the key take-aways of a presentation by the Insurance & Financial Services Ombudsman.

Karen Stevens heads-up the organisation that provides dispute resolution services for consumers with complaints about their financial services provider.

During a webinar hosted by Financial Advice NZ on Wednesday 9 September, Stevens – who has a background in law and alternative dispute resolution – reminded viewers that all financial advisers have an overriding obligation to their clients.

And that when it comes to changing a client’s insurance provider an adviser should not leave them with less cover just to reduce premiums “…unless you have had a very serious conversation with your client and they fully understand they will get a reduced package if they pay less”.

“Your financial advice must take into account your client’s circumstances, so check any assumptions you made about the client and your solution for them,” says Stevens.

“You also need to, when talking about the suitability of advice, have absolutely covered off your client’s financial situation, needs, goals, and risk tolerance.”

Stevens said that under the Financial Services Legislation (section 431J) advisers have a duty of care to their clients.

“If you have two or more products before a client, you must base your financial advice on an assessment of each,” said Stevens.

And when it comes to complaints, Stevens cautions advisers against attributing blame on to the consumer; especially if the complaint is successful.

“The last thing you should do is say ‘I am offering a lower [compensation] because you were [also] at fault’. Spreading the blame – that doesn’t work.”

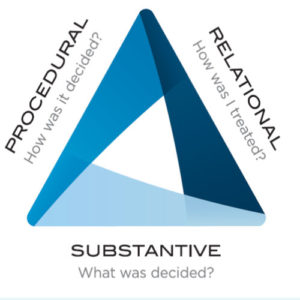

Stevens says consumers look at fairness in different ways, and points to the Consumer Triangle from Canada that identifies the three aspects of fairness most people believe are important when determining the outcome of a complaint:

- Procedural – how was it decided

- Relational – how as I treated

- Substantive – what was decided

“Fairness is in the eye of the beholder,” said Stevens. “People will always look at things and say ‘it’s not fair’.

“But if they believe they have had a fair hearing and had all the circumstances taken into account then it helps.

“In March, when the new regime starts, advisers will have to demonstrate to the FMA how they treat clients fairly.”

She said that among the key tests are:

- What factors do you take into account when determining what is fair for your clients?

- What is your ‘fairness infrastructure’?

- How will you demonstrate that you always treat clients fairly and act in their interests?

Webinar viewers heard that the new regulatory regime is more about demonstrating and showing that you comply than it has been previously.

“That’s going to be very important in the new environment with the new code. It’s more specific, has a wider scope and a higher bar.”

Watch the full webinar here.