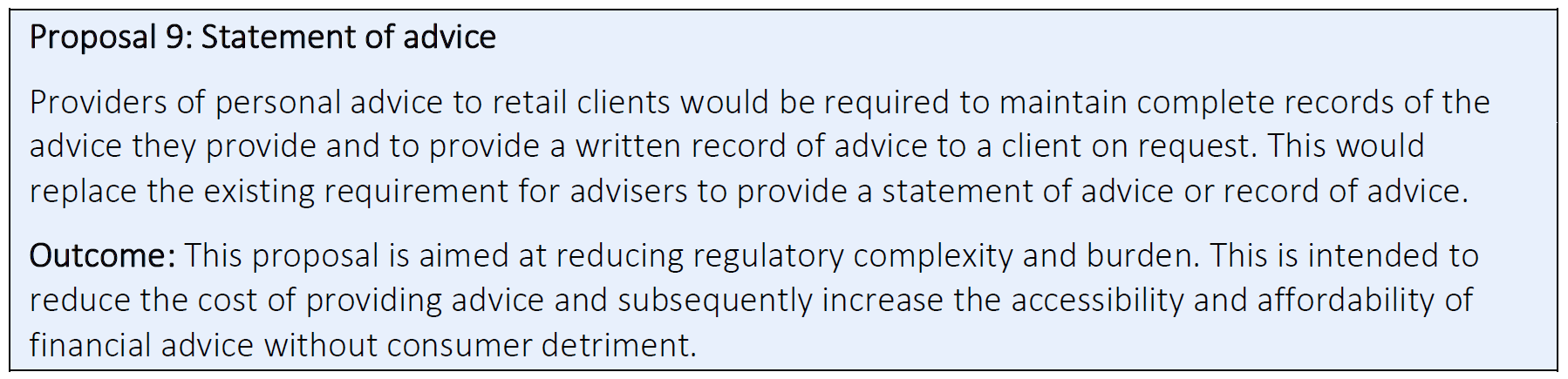

The Federal Treasury in Australia has released a consultation paper outlining the interim findings and reform proposals for Michelle Levy’s Quality of Advice Review, in which some of the key recommendations include scrapping Statements of Advice and replacing the Best Interests statute with a new ‘good advice’ requirement.

The interim report, which includes 12 proposals, recommends the removal of a significant raft of compliance requirements – including the abolition of annual fee disclosure statements – which are impeding advisers across The Ditch from delivering affordable advice to many Australian consumers, but it falls short of making any recommendations in relation to addressing life insurance commission caps.

In her introduction, the independent reviewer notes the purpose of the Review is to consider whether changes should be made to the regulatory framework applying to financial advice to improve the accessibility and affordability of financial advice: “My answer to that question is ‘yes’”, says Levy, adding that the changes need to be substantial if financial advice is going to be widely accessible and truly affordable.

She says it is clear the current regulatory framework in Australia is a significant impediment to consumers accessing financial advice and that it is preventing advisers and institutions providing advice and assistance to their customers: “The proposals in this paper are intended to make it easier for consumers to access financial advice that meets their needs from a range of different providers and for advisers and financial institutions to have more helpful conversations with their customers.”

The proposals in this paper are intended to make it easier for consumers to access financial advice…

Levy notes some stakeholders might be concerned that the proposals would retract what she refers to as hard fought changes intended to protect consumers, to which she responds:

“I do not hold that view. The proposals are intended to make it easier for consumers to get personal advice. Therefore, they are also intended to make it easier for providers of financial advice – financial advisers, product issuers and digital advice providers – to provide personal advice.

“In my view this greater ease is achieved without introducing a corresponding risk of harm to consumers, who will be protected by a proposed new obligation to give good advice and by the many existing consumer protection provisions in the law.”

Life insurance commission caps

The consultation paper notes it does not include any proposals in relation to life insurance and general insurance commissions because the Treasury is still collecting information on these and other areas. It says it expects to receive life insurance data from ASIC by the end of September 2022.

The paper adds that while it is not intending to release another proposals paper, the Treasury will continue to discuss proposals as they are developed and that there will be an opportunity for stakeholders to provide further feedback.

You can click here to access a copy of the Quality of Advice Consultation paper – Proposals for Reform.