The Financial Markets Authority (FMA) has voiced its concern about the influence that soft commissions have on advisers’ behaviour, in a review into the structure of soft commissions from life and health insurers released today.

FMA Director of Regulation, Liam Mason, said the regulator’s concern was that the incentives designed and offered by insurers could lead advisers to fall short in complying with their obligations.

“…our concern is that these very large and sales-skewed incentives do make it harder for advisers to manage conflicts of interest and to fulfil their duties to customers. So we think that providers have a responsibility as designers of these incentive schemes,” Mason told RiskinfoNZ.

The FMA previously detailed how some RFAs were unaware of their need to manage conflicts of interest while providing advice to their clients (see: FMA Cracks Down…).

“…our concern is that these very large and sales-skewed incentives do make it harder for advisers to manage conflicts of interest.”

Mason said insurers “…must acknowledge the need to promote good customer outcomes and take responsibility for conflicted conduct that results from these incentives”.

The regulator said it expects insurers to consider the number and nature of soft commissions they provide to advisers, to minimise the chance of conflicted conduct.

It stated the report’s findings indicated that advisers seem to be the main beneficiaries of the soft commissions provided by insurers – it is difficult to discern any direct benefit to consumers.

“It doesn’t seem as though there is very strong direct financial benefit even for insurers…they’re not making a lot of money out of these [soft commission incentives]…it’s only surmised on our part but we think that the principal goal is adviser loyalty,” Mason said.

He added it’s what is being rewarded that is likely to create conflicts rather than what types of commission are offered.

“We don’t have a beef with how much advisers earn but we are concerned about the way that it’s structured…”

“We don’t have a beef with how much advisers earn but we are concerned about the way that it’s structured – so if it’s all structured to upfront commissions and soft commissions that are only for sales then our worry is incentivising a very specific part of behaviour as opposed to incentivising good advice,” he explained.

The report noted that one insurer’s sales fell by a third during the period, after it ceased offering its overseas trips.

The FMA said this supports what it found in other reviews – that soft commissions directly influence adviser behaviour.

The recent FMA report into adviser conduct when replacing insurance policies found a direct connection between incentives like overseas trips and switching policies to reach volume targets.

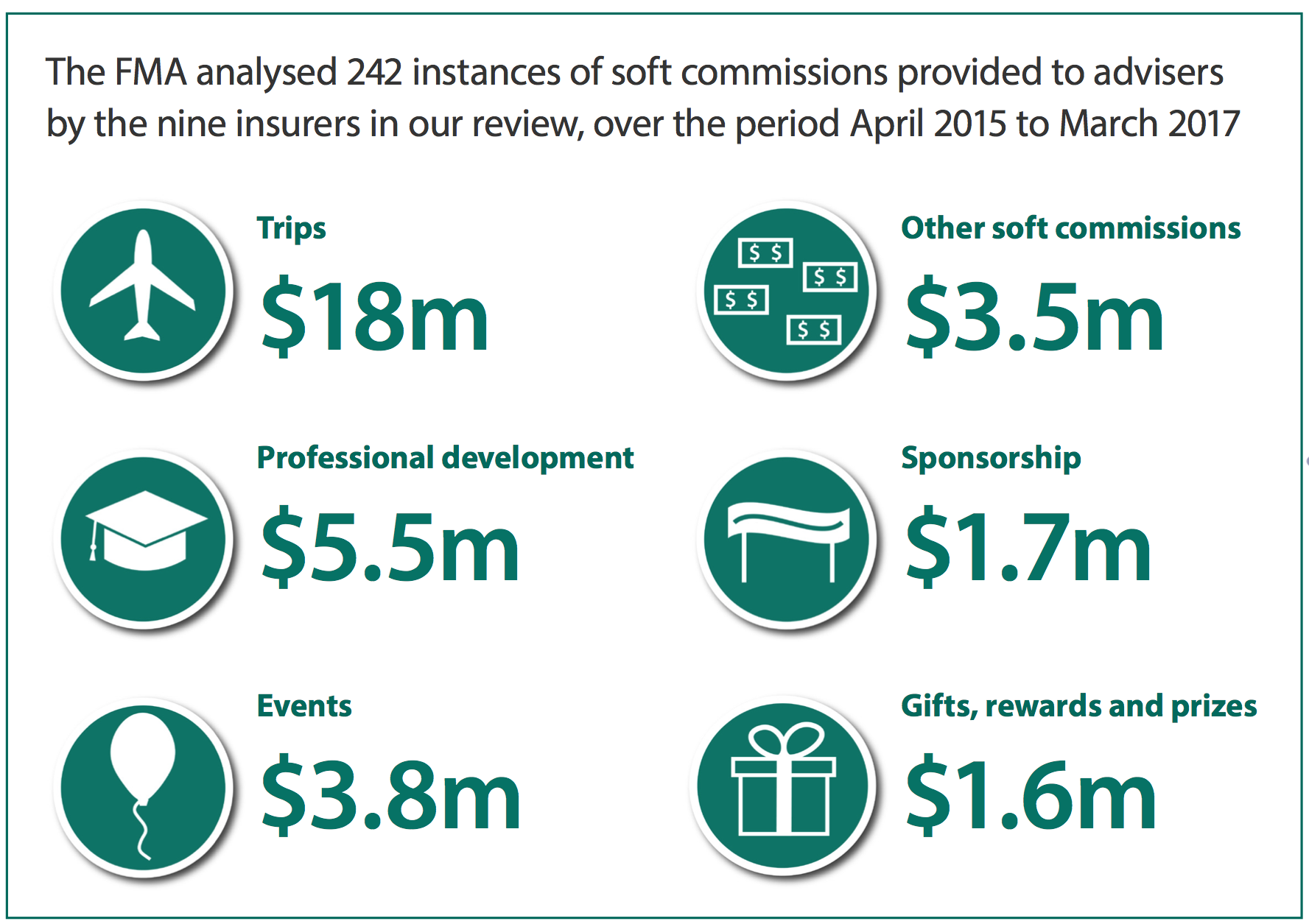

Today’s report found insurers spent 9% of their revenue from new product sales in the form of soft commissions.

By value, the largest type of soft commission was insurance companies taking advisers on trips. Insurers spent $18 million on this type of incentive, 24 of these trips were international, while 5 were domestic, to destinations such as Tahiti, China, Britain, Japan and Queenstown.

Commenting on the report, Financial Services Council CEO, Richard Klipin, said, “The key issue with remuneration is clients’ right to know the who, what, and why of the advice they’re receiving and if it’s linked to remuneration at all.”

He said advisers need to ensure the information provided to their clients answers three questions:

- Do you get any incentives/commissions from the provider you are recommending? If so, what are they?

- Will you receive any other benefits as part of me giving you my business?

- If your adviser is recommending that you change providers: Will my benefits and cover remain the same?

The FMA stated it will be releasing two further reviews examining insurance replacement business practices in QFEs (large financial institutions) and the structure of bank incentives in the sale of financial products.

Click here to view the FMA’s full report.