Another insurer has added its voice to the growing number of calls for the retention of life insurance commissions as a valid remuneration option for Australian advisers.

Speaking at the annual FSC Life Insurance Conference last week, and in a subsequent statement, ClearView MD, Simon Swanson, outlined his firm’s reform agenda and priorities post the release of the Banking Royal Commission recommendations.

While stating that ClearView broadly supports the recommendations made by the Banking Royal Commission, Swanson zeroed in on what he described as some elements worth protecting, “…namely the ability for product manufacturers like ClearView to fund the provision of life insurance advice through commissions.”

In a perfect world, consumers would …pay a fee …but that’s not how it works

Swanson’s rationale stems in part from how he says life insurance advice works in the ‘real world’: “In a perfect world, consumers would autonomously recognise the value of life insurance advice and willingly pay a fee for it,” says Swanson, before adding, “…but that’s not how it works.”

He reflects, “The truth is life insurance is a complex financial product,” saying that while it offers many benefits, these benefits may not be realised for 20-30 years. “While insurance provides comfort and peace of mind, and allows consumers to transfer risk to an insurance company, they’re effectively buying a promise. Financial advisers play a critical role because they help consumers understand and assess the value,” he said.

Swanson warns of the consequences if risk commissions were removed or further reduced, including the exacerbation of Australia’s ongoing underinsurance dilemma, quoting research which places the shortfall at around $1.8 trillion.

He notes ClearView’s three three key advocacy priorities are:

- Stable life insurance commission rates

- Tax deductibility of financial advice fees

- Life insurance choice of provider

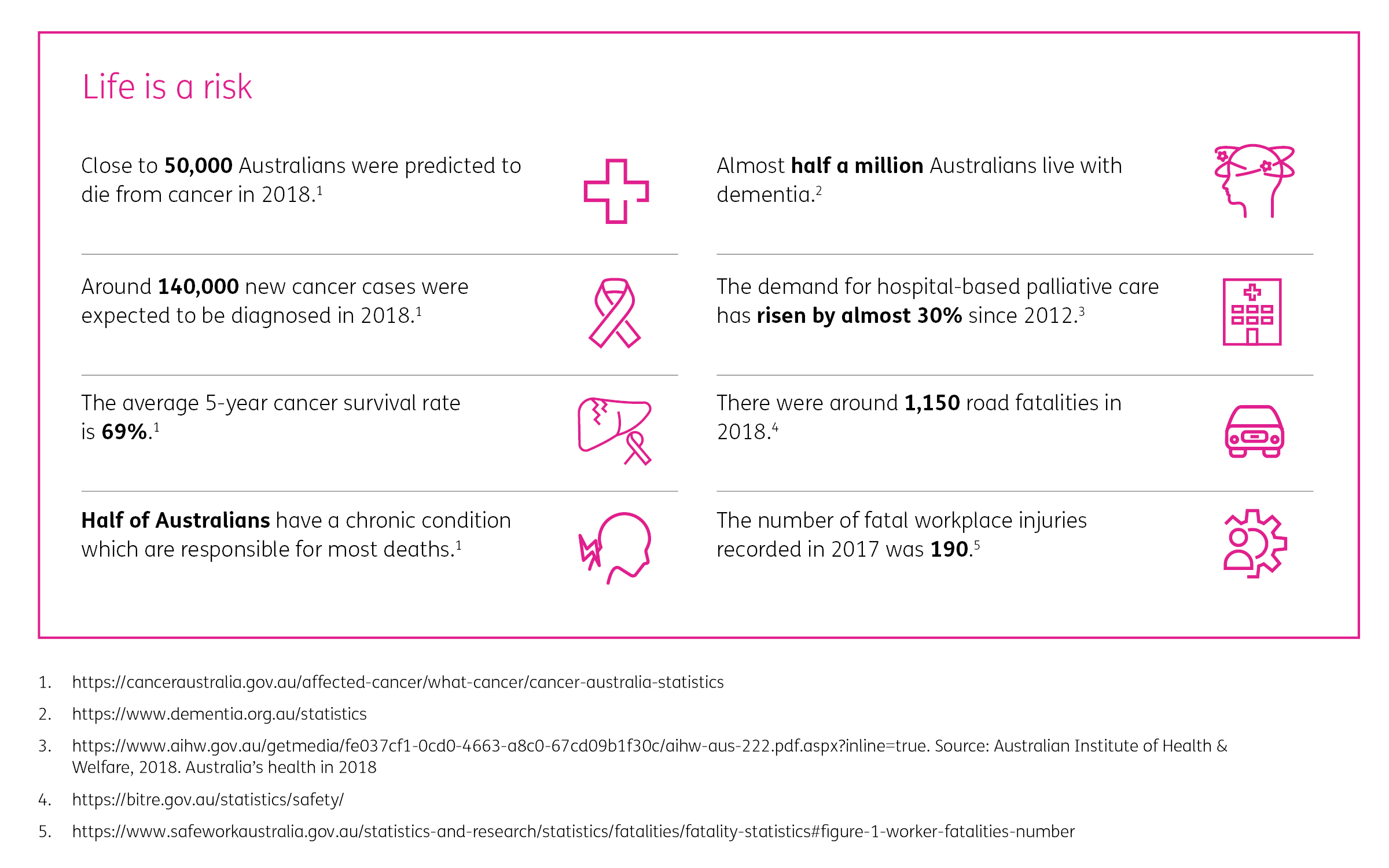

Advisers can click here to access ClearView Wealth’s Reform Agenda and Priorities statement, which includes its arguments in support of these three key advocacy priorities, as well as the following infographic that outlines some of the risks associated with life in Australia: