The pandemic has seen a spike in life risk sales for the June 2020 quarter, according to data from DEXX&R’s Life Analysis Report.

A statement from the company says that in Australia, Individual Lump Sum and Disability Income new business increased by 10.4 percent and 22.6 percent respectively over the June 2020 quarter “… notwithstanding the impact of the Australia-wide Covid-19 pandemic lock down during the June quarter.”

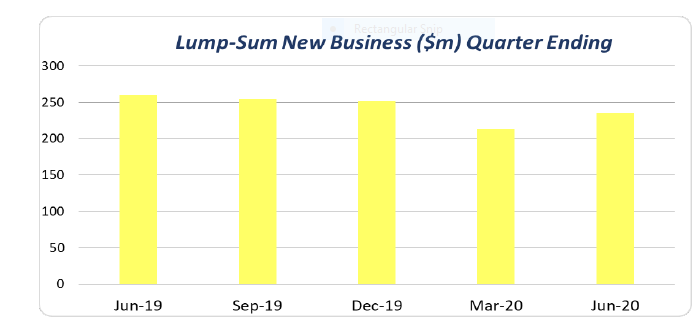

It says that during the June quarter individual lump sum new business increased to AU$236 million, $22 million more than the $213 million recorded in the March 2020 quarter.

However, the report notes that June new business was down by 9.5 percent when compared to the $260 million in lump sum new business written in the June 2019 quarter.

Over the year to June 2020 Total Risk new business decreased by 4.9 percent to $2 billion “… largely due to low sales experienced during a very poor start to 2020 in the March quarter”.

DEXX&R states that Individual Risk Lump Sum new business was down by 15.5 percent over the year to June 2020.

“The industry wrote $955 million of lump sum new business in the 12 months ending June 2020, down 15.5 percent on the $1.1 billion recorded in the year to June 2019. This is the lowest level of new sales recorded in the past five years,” it says.

…Disability Income new business in the June 2020 quarter was up 22.6 percent…

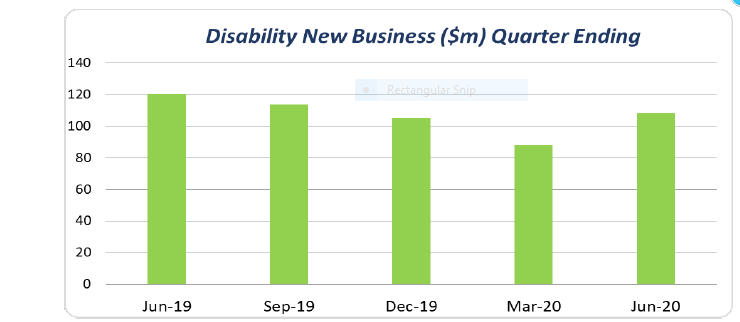

Meanwhile Disability Income new business in the June 2020 quarter was up 22.6 percent to $108 million from the $88 million recorded in the March 2020 quarter.

“However, June 2020 quarter sales were down 10 percent on the $120 million recorded in the June 2019 quarter.”

For the year to June 2020 Disability Income new business decreased by 10.8 percent to $414 million, a nine-year low, down from the $464 million recorded in the twelve months to June 2019.

DEXX&R attributes this fall to disruption in advice channels and the APRA mandated cessation of sales of Agreed Value Disability Income benefits from the end of March 2020.

The company says that the report includes data on all business issued by life companies from their statutory funds.