Retail lapse rates in Australia have surged since the implementation of Life Insurance Framework reforms, but the causes are not related to churning.

This is one of many findings documented by specialist financial services consulting firm, NMG Consulting, in its Australian Life Insurance Market Research Report, which was released in 2020.

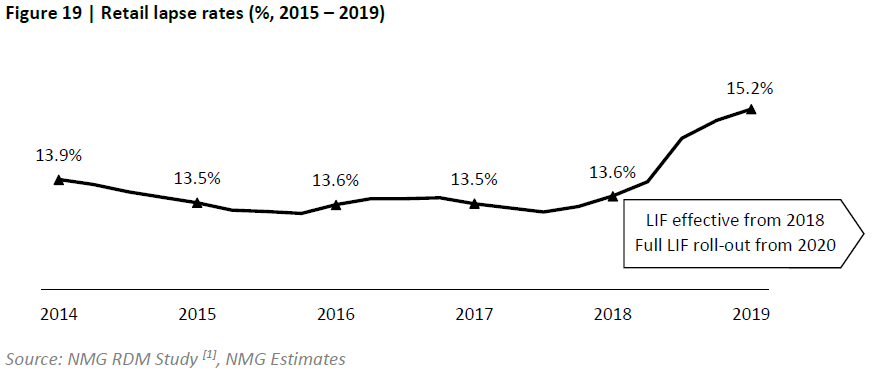

The following chart, taken from the report, paints the picture:

In its report, NMG notes it is an historical assumption that higher lapse rates are primarily a function of churning. But its research findings appear to contradict this assumption.

In what may be considered by some industry stakeholders as ironic, the consulting firm attributes this sharp increase in retail lapse rates in recent years, represented in the above chart, not to churning, but to these three primary drivers:

- An increase in ‘partial lapsation’ (reductions in cover and premium)

- An increase in compulsory lapses (policy lapsing at maximum age)

- Policy holders lapsing out of the system (cancelling the policy with no replacement)

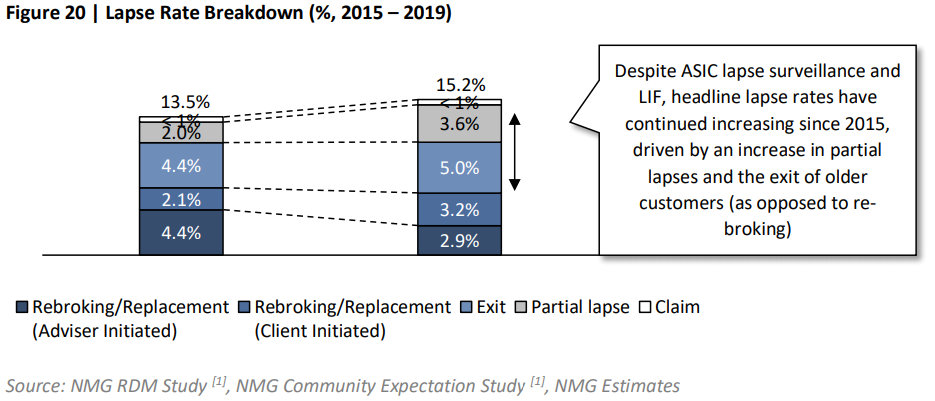

Comparing lapse rates in 2015 with 2019, the report then breaks the causes into their components:

The chart breaks down ‘rebroking’ into adviser-initiated and client-initiated components, and the report goes on to reflect that it is challenged to differentiate between what it refers to as ‘adviser benefit driven’ lapsing (churning) and ‘customer benefit driven’ lapses.

…adviser driven re-broking is unlikely to be a significant element of re-broking

While NMG says it cannot be definitive because it hasn’t had access to case-by-case file reviews, its report nonetheless draws some conclusions when it notes:

“…we can reasonably assume that in the current environment (with ongoing ASIC lapse surveillance and file reviews) and in the context of heightened scrutiny by licensees as well as insurers, adviser driven re-broking is unlikely to be a significant element of re-broking.

The overall picture painted by these research findings appears to support the contention held by many advisers and other industry stakeholders that the relative incidence and impact of churning life insurance business in the Australian market – an issue of critical importance in the shaping of the Life Insurance Framework reform legislation – appears to be somewhat anecdotal in nature, as opposed to being supported by any fact-based research or rigour.

…international markets with materially higher initial commission rates show consistently lower lapse rates

The research paper appears to reinforce this point in adding that, if anything, an inverse relationship exists between initial commission levels and lapse rates. It reflects that “…international markets with materially higher initial commission rates show consistently lower lapse rates.”

In providing context, NMG Consulting’s Australian Life Insurance Market Research Report was commissioned by Australia’s big four life insurance groups in conjunction with the AFA, FPA and FSC, which in turn informed the basis of this group’s ‘Choice & Access to Life Insurance’ (CALI) campaign in June 2020 (see: Underinsurance Will Worsen…).

The CALI campaign’s focus at the time related to various issues including community attitudes and expectations, the future outlook for advised life insurance, international comparisons, regulatory reform and affordability. While lapse issues were included, they formed a single component within a broader narrative.