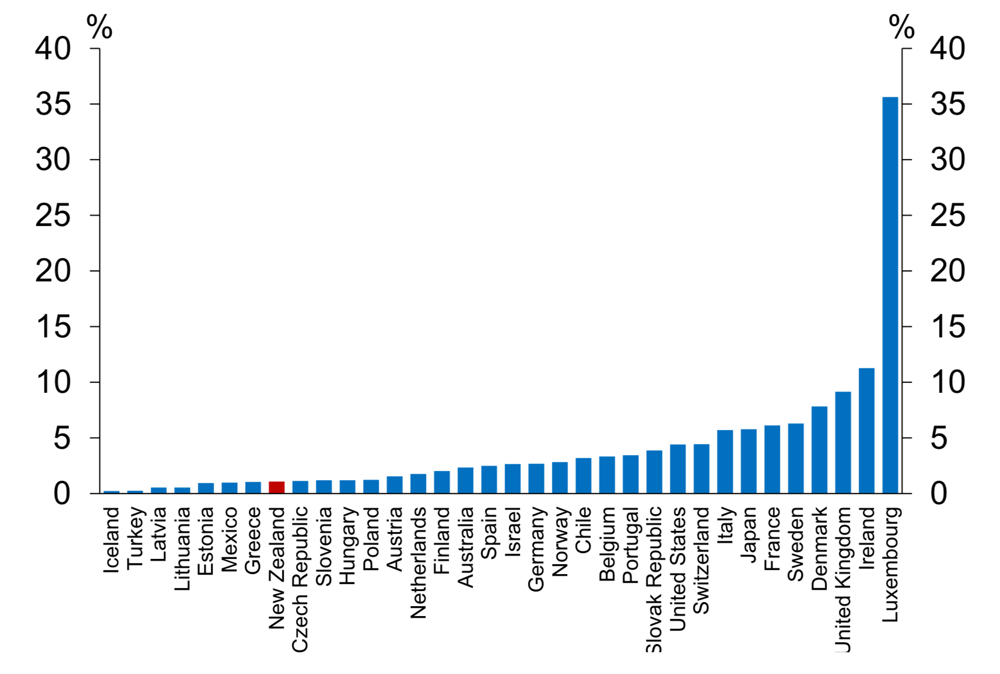

It’s no secret that New Zealanders have low engagement when it comes to risk insurance. In a list of 34 OECD countries we are placed at 27 by the RBNZ when it comes to life insurance penetration.

A report published by the RBNZ says there is relatively low coverage of New Zealanders’ death and disability risks, and this may be explained by the low proportion of [insurance-linked] savings products, together with New Zealanders’ reliance on ACC cover.

It’s a claim AIA’s Len Elikhis, Chief Officer Product & Vitality, tends to agree with.

“In the mind of consumers, and in practice, the public safety net and ACC are substitutes for private insurance,” he says.

“It is an imperfect substitute as there are gaps relative to the types of cover that can be purchased privately, but there is something. And when you compare it to other countries – for example, the United States where public services are generally limited – there is more pressure on consumers there to buy insurance if they want to be protected.”

Elikhis says the most challenging issues are low customer engagement and low-levels of financial literacy among New Zealanders, and that the industry could do more to engage with the un-insured and under-insured.

We as an industry, financial advisers and insurers, need to find ways to engage with customers…

“We as an industry, financial advisers and insurers, need to find ways to engage with customers, and make it easier for them to understand the products on offer, and why they have a need for them,” he says.

“Advisers do a great job with one-on-one consultations, but the challenge is doing it at scale. Banks do a good job engaging with schools to build savings habits, and the insurance sector could do that as well.”

The OECD insurance penetration ranking graph

However, he concedes there is an affordability issue in New Zealand, and this could be due to people buying their first home later in life than 30 to 40 years ago when a home could be bought based on three or four times annual income – rather than today’s seven to 10 times annual income (particularly in Auckland).

“There are rising housing costs, so people are just choosing to buy less insurance,” says Elikhis.

He says when people buy their first home it is often a stepping stone to buying cover, with the average age of a new customer being in their 40s.

“If you’re taking out cover for the first time at age 40 then the cost is going to be higher because the risk is higher,” says Elikhis.

“Customers are often prompted to consider their insurance needs when they take a mortgage,” he says. “And the trend of people deferring the purchase of their home or exiting the property market makes it harder for us to reach these customers.”

Encouraging more people to take out insurance is a multi-faceted issue that’s compounded by an apathetic population, he says.

…providing customers with default insurance cover through their Kiwisaver is a cost-effective way to improve coverage rates…

“One way to deal with the apathy issue is through policy,” says Elikhis. “For example, providing customers with default insurance cover through their Kiwisaver is a cost-effective way to improve coverage rates.

“One of the benefits of this approach is that Kiwisaver members would get insurance without going through any underwriting, because there will be some people who will not be able to access insurance in any other way.”

Elikhis points to Australia (placed 19 in the RBNZ graph) where insurance is available via its compulsory Super scheme.

“And that’s an example of how [government] policy can drive change,” he says.

“There is also room to develop products to counter the affordability issue that cover customers for specific things, and this would be priced lower than full cover.”

For example, AIA has a cancer-only medical product that’s priced at around 25% of full medical insurance.

“We did this because we know people want to have cover but can’t afford the premiums for full medical insurance,” says Elikhis. “So more product innovation across the sector could would be helpful.”

In a survey the FSC found two-thirds of respondents thought there was a moderate to high risk of experiencing major financial difficulty should a significant event happen, such as a serious injury or being unable to work.

Just under 40% of those surveyed cited an inability to afford life insurance premiums, a quarter said life insurance is not a priority, and around 17% did not feel life insurance represented value for money.

What is the single most important action that should be taken to address the under-insurance issue in New Zealand?

- Improve financial literacy (40%)

- Ask government to include life insurance with all Kiwisaver plans (18%)

- Make life insurance compulsory for all mortgage payers (12%)

- I have a different idea (12%)

- Develop lower-priced and more flexible life cover products (11%)

- I don't believe under-insurance is an issue (6%)