New consumer research released by Australian regulator, ASIC, has confirmed consumers see value in financial advice but that barriers, including the trust factor, prevent many from embracing it.

ASIC’s Report 627, Financial advice: What consumers really think presents expansive independent research into consumer experiences of financial advice and attitudes towards financial advice and the advice sector.

The research focused on three key areas:

- The overall use of financial advisers

- Motivators and barriers to seeking personal advice

- Consumer attitudes towards the financial advice industry

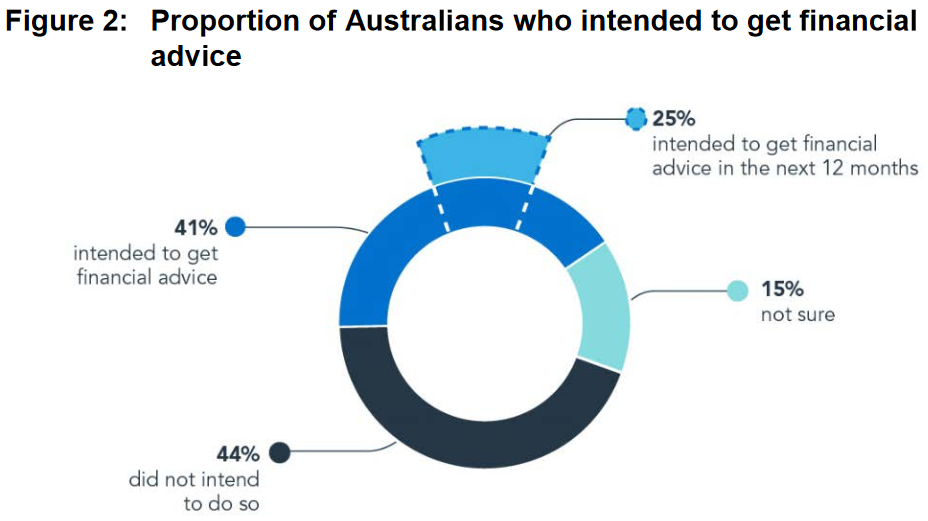

One of the critical findings in the research – highlighted by the regulator – was that, while 41 per cent of Australians intend to get personal financial advice in the future, many of them will not proceed because of perceived barriers, which include:

- High costs

- Significant distrust of the industry

- A perception that financial advice is only for the wealthy

ASIC Commissioner, Danielle Press, noted that while Australians believe financial advisers can offer significant expertise on financial matters, “…our research shows that many don’t seek advice because they are put off by these factors.

The research also found that 27 per cent of Australians had received financial advice in the past, and 12 per cent of Australian consumers received advice in the past 12 months. It also highlighted that a significant majority of consumers sought financial advice because they felt advisers had expertise in financial matters and could recommend products that they, as consumers, could not normally find on their own.

‘The good news for industry,” said Press, “…is that consumers who had recently received financial advice had more positive attitudes towards financial advisers than those who had not.” She added that even limited knowledge of industry reforms such as the Future of Financial Advice reforms appears to have improved consumer attitudes towards the sector. “So, it is even more important for industry to get on board with the reforms,” she said.

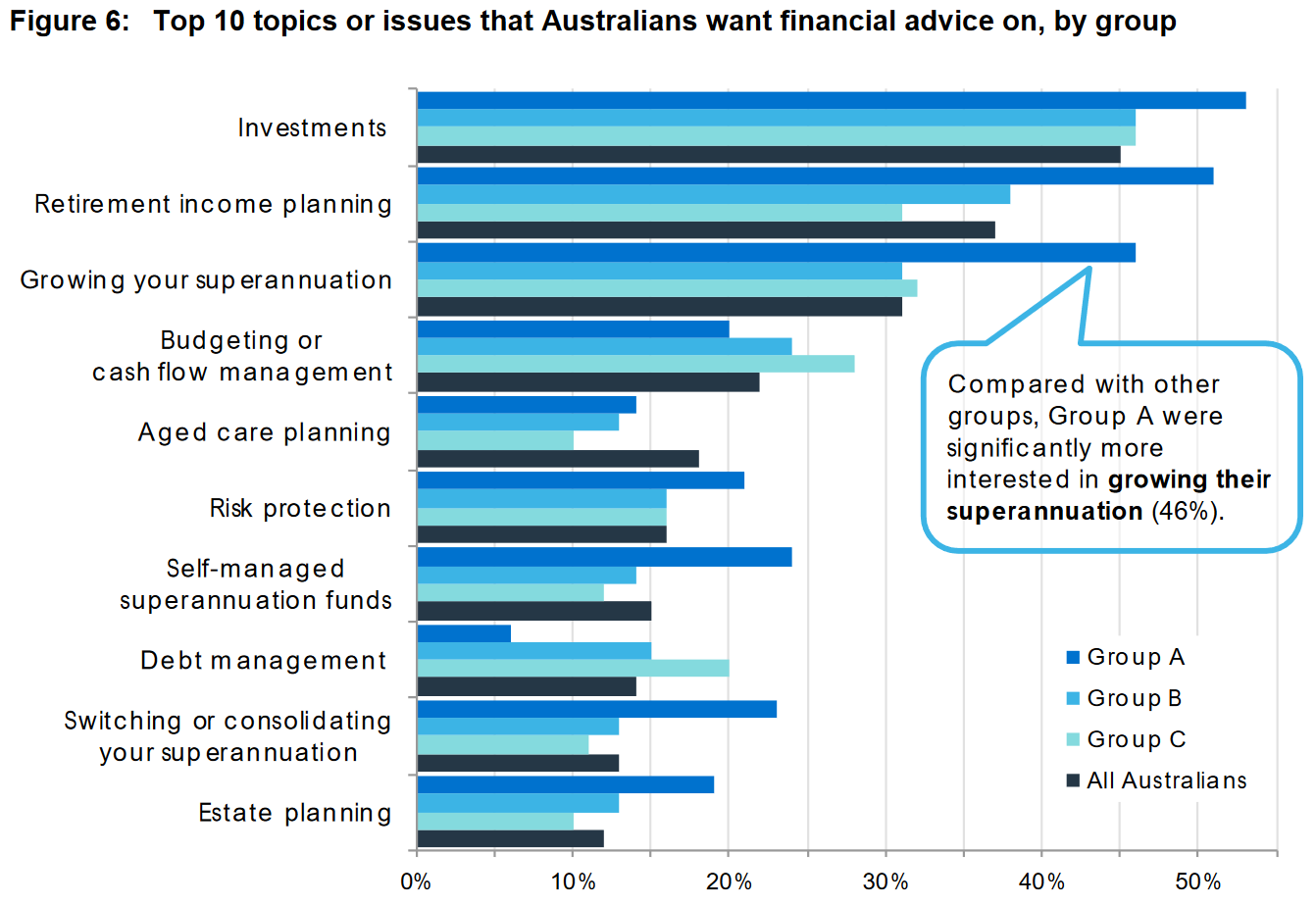

The research found that consumers generally seek financial advice for investments such as:

- Shares and managed funds

- Retirement income planning

- Growing their superannuation

- Budgeting or cash flow management

ASIC also highlighted a report finding that use of digital or robo-advice is still very low, at around one per cent, but that 19 per cent of research participants said they were open to getting digital advice once it was explained to them.

Press acknowledged that financial advisers have an important role to play in helping consumers improve their financial position, and there is a real opportunity for the advice industry to rebuild that trust by reorienting itself and putting consumers at the heart of its services.

We encourage advisers to click through to read this report, which contains some excellent perspectives on current consumer attitudes around key areas including:

- Overall demand for advice

- Use of digital or robo-advice

- Most popular advice topics

- Reasons people use financial advisers

- How people use financial advisers

- Barriers to getting financial advice

- Attitudes towards financial advisers

Background Note: Report 627 highlights findings from quantitative and qualitative research commissioned by ASIC and undertaken by independent market research agency, Whereto Research. The quantitative research involved an online survey of 2,545 participants, which was weighted to ensure that it was representative of the Australian population.