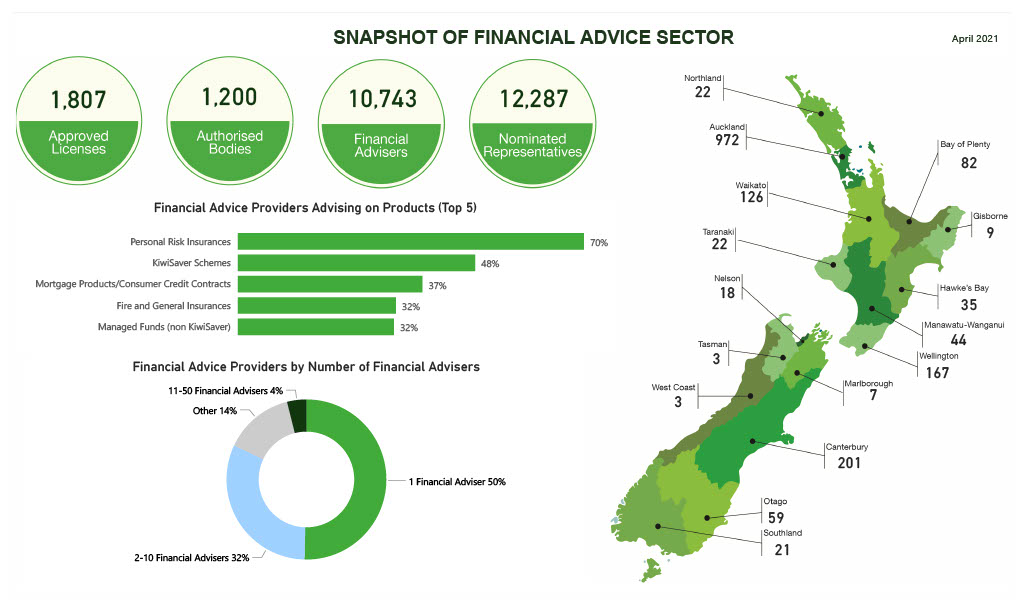

Personal risk insurance, such as life cover, is the most popular product for 70% of the country’s financial advisers, according to the FMA. This is followed by KiwiSaver (48%), and mortgage products and consumer credit contracts (37%).

In an update on the new licencing regime, the regulator says more than 3,000 financial advice businesses, comprising of 1,807 financial advice providers and 1,200 authorised bodies, have so far been licensed by the FMA. Together, the businesses currently engage 10,743 financial advisers and 12,287 nominated representatives.

John Botica, FMA Director of Market Engagement, says the statistics highlight the continuing presence of small advice businesses, and that 82% of financial advice providers are businesses with fewer than 10 financial advisers.

Geographically, more than half of financial advice providers are based in Auckland, although Botica says these businesses may have advisers across the country. The next region with the most financial advice providers is Canterbury.

Botica says the next crucial step for financial advice providers is to ensure they formally record details of the advisers they’ve engaged by linking to them on the Financial Service Providers Register (FSPR).

Financial advisers who are not linked to a financial advice provider by 16 June 2021 may face deregistration, says the FMA. Full instructions about the linking process are on the Companies Office website.

About the new financial advice regime

- The new financial advice regime came into force on 15 March 2021.

- Providers of financial advice and their advisers must now:

- Have a transitional licence and be able to comply with its standard conditions.

- Comply with new duties under Part 6 of the Financial Markets Conduct Act 2013.

- Comply with the new Code of Professional Conduct for Financial Advice Services.

- Provide the prescribed disclosures.

- Financial advice providers have a two-year transitional period, by the end of which they must hold a Financial Advice Provider full licence.

- The FMA is now accepting applications for full licences.