Only 20% of New Zealanders have insured their income against sickness or disability says the FSC in its Perception Gap report.

Its research suggests consumers don’t like to talk, or think about, the things that could impact their personal or family financial situation. Many are unsure about the benefits of insurance, while some are happy to self-insure or rely on Government for help (ACC).

The FSC says its survey shows that those with life insurance cover see the positives such as:

- Peace of mind

- Reducing stress on loved ones

FSC data shows the New Zealand life insurance industry supports around 4.1 million life insurance policies that include life, trauma, disability, and income insurances, and last year paid around $1.2bn in claims.

Looking at four types of life insurances, its research revealed New Zealand is underinsured, with just:

- 39% holding life insurance cover

- 22% holding trauma/critical illness insurance

- 20% holding income protection insurance

- 17% holding total and permanent disability insurance

Nevertheless, 82% of respondents self-reported financial confidence, yet many aren’t managing their income risks effectively.

The top five circumstances that would see respondents take out any of the four types of life insurance policy to cover income include:

- Affordability

- Declining health

- Starting a family

- If it was more simple to understand and apply

- If any insurance company could better explain the benefits

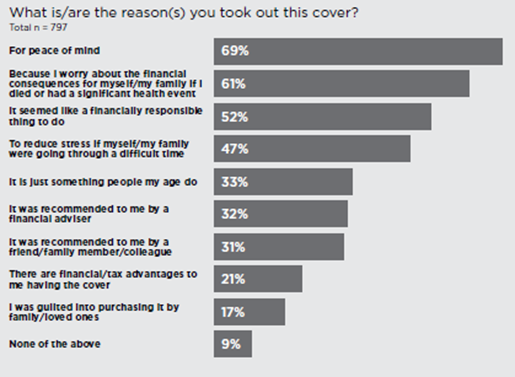

Focussing on life insurance, the following table sets out the feedback from the 39% of Kiwis who hold life insurance cover:

Looking at the data across different age groups, the FSC states it is more likely that 29 to 57-year-olds will hold life insurance with older generations, those 58 or older, more likely to have previously had life insurance, but no longer do.

The report confirms New Zealand is one of the most underinsured nations in the OECD and the levels of risk are only increasing.

Click here to request access to the full Money & You – The Perception Gap report.