The Government is considering the possibility of capping upfront and/or trail commissions for intermediaries of insurers and banks and banning products that lead to poor customer outcomes, as revealed in an options paper for its Conduct of Financial Institutions review.

The review follows the release of reports from the Financial Markets Authority and the Reserve Bank of New Zealand which uncovered failures in how conduct risk is managed among banks and life insurers (see: Regulators Life Insurance Report…).

Commerce and Consumer Affairs Minister, Kris Faafoi, says the Government is bringing financial safeguards for consumers a step closer with the much-needed improved protections outlined for consultation in the options paper.

“Everyone should be able to rely on their banks and insurers,” said Faafoi.

“Unfortunately while some have put consumer interests first, the recent reports by the FMA and RBNZ showed that there [are] major issues in the life insurance sector and poor conduct and culture in the banking sector that needed to be addressed,” he said.

“What we propose is a suite of new measures that will put the consumer at the heart of decision-making and make good outcomes the bottom line.”

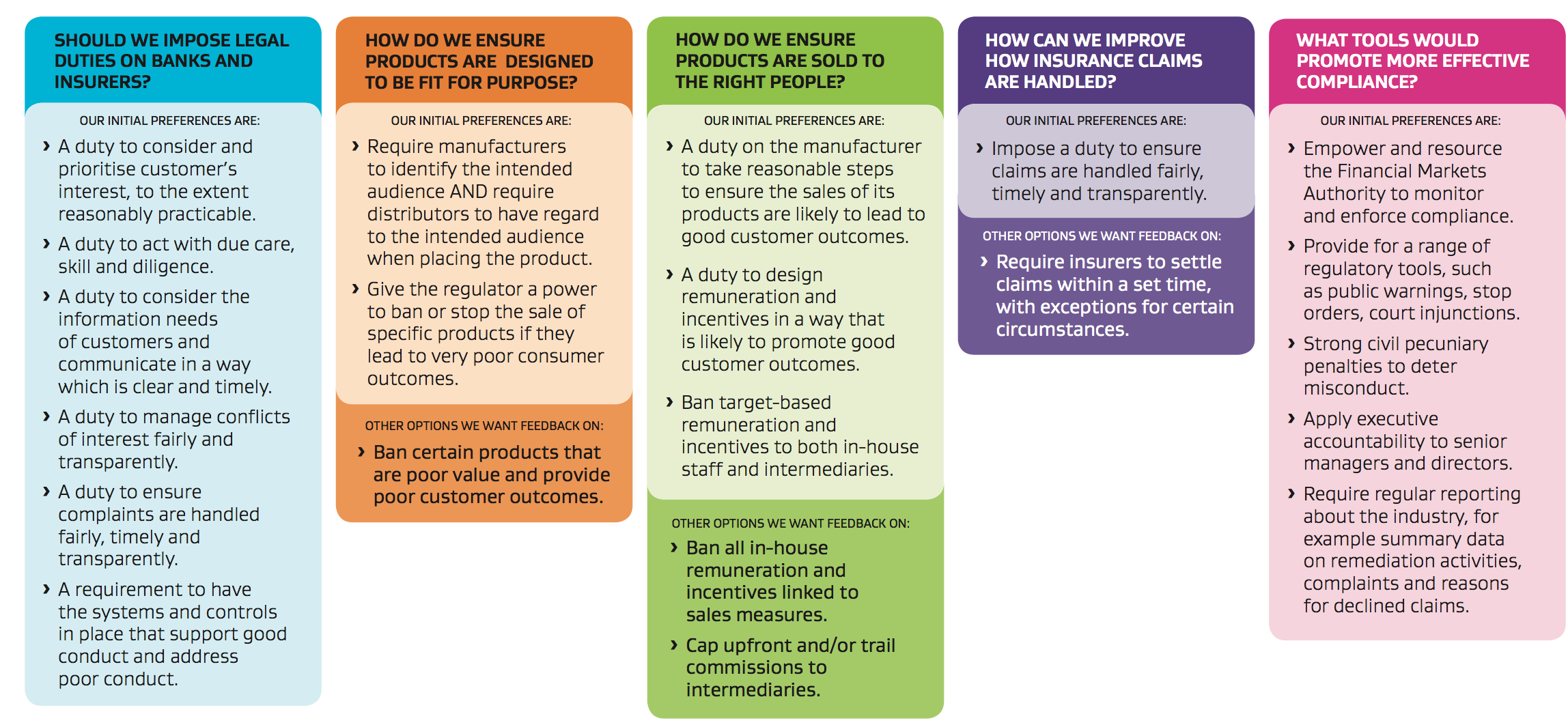

The following measures are not included among the Government’s initial preferences but they are seeking feedback on the possibility of:

- Banning poor-value products that result in poor customer outcomes

- Capping upfront and/or trail commissions to intermediaries

- Banning all in-house remuneration and incentives linked to sales measures

- Requiring insurers to settle claims within a set time, with exceptions for certain circumstances

All the measures for consultation are included in this consumer summary provided by the Government:

Faafoi noted the conduct and culture reviews highlighted weaknesses not only in how issues are managed but also a gap in how financial institutions are regulated.

“This makes it harder for regulators to deal with failings such as sales taking priority over good consumer outcomes, weak systems and controls to manage conduct risk, and a lack of accountability to ensure good conduct,” he said.

“These issues are serious because they harm consumers and reduce confidence in our financial system. They are similar to the issues highlighted by the Australian Royal Commission, though not to the same extent.”

Financial Services Council CEO, Richard Klipin said, “These latest options papers are important as they speak to improving financial services across the entire sector for the benefit and wellbeing of consumers, and are wide-ranging in their scope.

“We are committed to driving great consumer outcomes, helping consumers better manage risk and being part of the solution to support New Zealanders grow, manage, and protect their wealth” he said.

“We will now consider the proposals in detail, before providing a comprehensive response to the Government.”

Click here to read the options paper in full.

…And click here to make a submission on the fast-tracked measures, open until 7 June, with the Government on schedule to have the measures introduced to Parliament later this year.

The Government has also released an options paper for its ongoing review into insurance contract law (see: Review of Insurance Contract Law Options Paper Released…).