New Zealanders are significantly underinsured according to the findings of the FSC’s latest research report Money and You – Taking Cover.

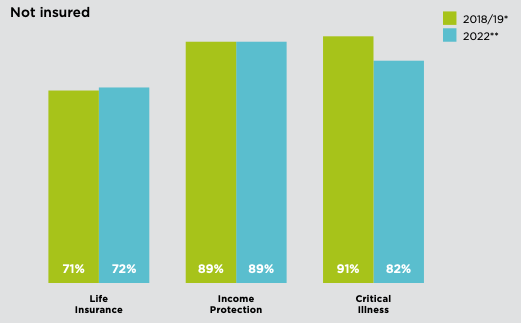

The survey of more than 2,000 Kiwis found around 70% are underinsured, just 11% have income protection, 14% have TPD, and 18% have cover for trauma or critical illness.

According to the report, the number of Kiwis without life insurance in 2018/19 was 71%, but today that figure has risen slightly to 72%.

Among the reasons given for taking out life cover include taking the advice of their financial adviser (21%), peace of mind (45%), and because they are worried about a health event (53%).

…the latest findings are cause for alarm…

When it comes to consumers researching money matters, 58% of Gen Ys talk with family and friends, but 41% of baby boomers consult a financial adviser (Gen Y 28%). The most popular social media sites for those looking for help with their finances are YouTube and Facebook.

FSC CEO Richard Klippin says that with the current cost of living crisis, an overwhelmed health system, and interest rate rises, Kiwis are struggling.

“Many haven’t lived through a recession or severe financial shock before and will be looking for support,” he says.

“While it’s understandable some are, and should be, prioritising immediate needs, the latest findings are cause for alarm.”

Klipin says there are six in 10 Kiwis whose families would be left to cover things such as funeral expenses, mortgage repayments, and to make ends meet with a loss of income should they suddenly pass away.

…over half of respondents find cost a major barrier to taking out insurance…

“Yet over half of respondents find cost a major barrier to taking out insurance, with 55 per cent saying they would take out an insurance policy if they had more money,” says Klipin.

“As an industry, we have a responsibility to help New Zealanders navigate the choppy waters and headwinds that are coming by making active and considered decisions about their financial futures.”