The financial advice profession in Australia could lose another 3,500 advisers, with thousands still on the fence about whether to stay or go, according to Adviser Ratings.

In a “sneak peek” article, the research firm says that for those who are undecided about staying, the uncertainty is partly driven by the wait for clarity on how experience will be recognised.

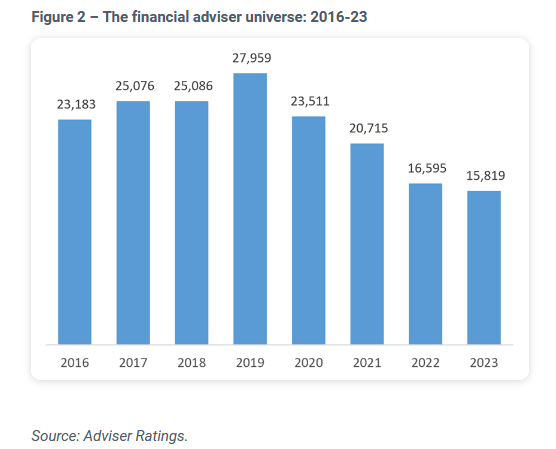

Adviser Ratings says this is based on analysis from its annual Financial Advice Landscape Report, noting that by the end of 2022, the financial advice universe had shrunk to just over 15,800 advisers, with more than 12,000 departing in the preceding five years.

“While there are positive signs the mass exodus has largely stalled, with a much quieter 12 months of departures last year, we still expect more than 1,500 advisers to leave,” the firm states.

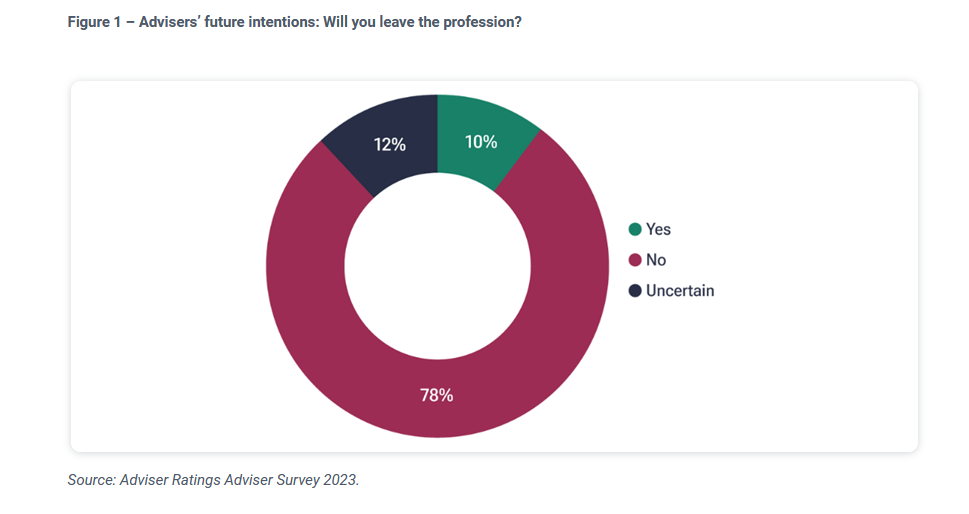

It notes its predictions are based on its annual adviser survey in which it asked professionals about their future intentions. “A further 2,000 are not sure whether they’ll stay at this stage.”

Adviser Ratings says while it’s unlikely that every adviser who is unsure will depart “…our analysis indicates the future of education standards will dictate the path for some advisers.”

Adviser Ratings says while it’s unlikely that every adviser who is unsure will depart “…our analysis indicates the future of education standards will dictate the path for some advisers.”

It explains that before winning the 2022 Federal election, the Government committed to scrapping tertiary education requirements for advisers who passed the exam, and had 10 years’ experience and a clean practice record.

The firm says that currently, advisers have until 2026 to complete their approved degree or bridging requirements. “However, the … Minister for Financial Services, Stephen Jones, said last year he would investigate how standards could change – in a practical sense – to recognise experience.”

Adviser Ratings says Jones has remained committed to keeping the adviser exam, but said Treasury would look at whether improvements could be made, such as reducing the number of questions. The consultation process also looked at how to attract new advisers to the profession at a time when numbers are quickly falling.

“We’re told the wait for certainty about what will happen with education requirements – specifically experience recognition – is creating anxiety among advisers,” it says.

The Adviser Ratings Landscape Report

The Adviser Ratings Landscape Report

The company says that the research on advisers’ future intentions was collected as part of its annual Australian Financial Advice Landscape Report, which paints a detailed picture of the financial advice market.

“For this year’s report, we’ve surveyed thousands of advisers, consumers and product providers, about topics including the demand for advice, practice health, areas of investment and divestment, profitability and revenue.”

It says that this year, it has incorporated more data sources, such as leads on the Adviser Ratings platform “..which provide rich information about who is seeking advice and what specifically they want.”

The firm will release 2023’s Australian Financial Advice Landscape Report later this month.