Disability income products from Partners Life can now be customised for clients based on their need and budget. The changes were signalled by the firm in June, with more expected to be revealed in October.

The company says introducing product flexibility demonstrates it has listened to industry feedback and that it is “…committed to helping make life easier and more affordable for clients”.

The customisations apply to its Partners Protection Plan products, with two benefits being renamed and made optional.

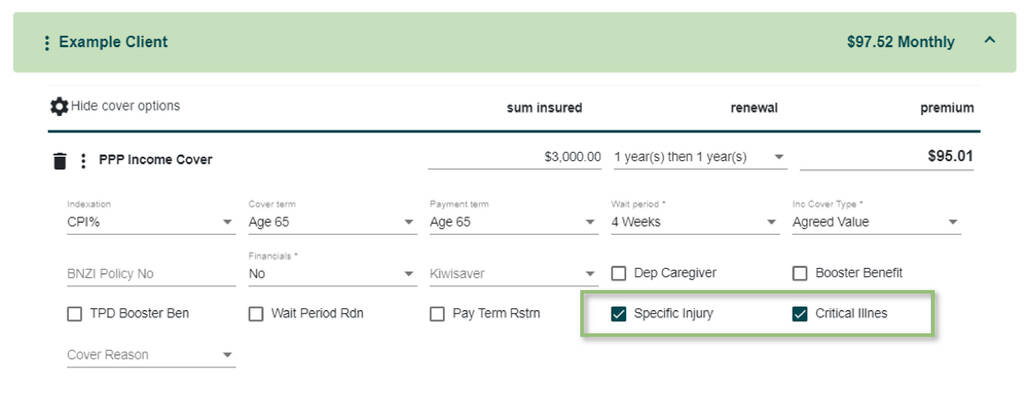

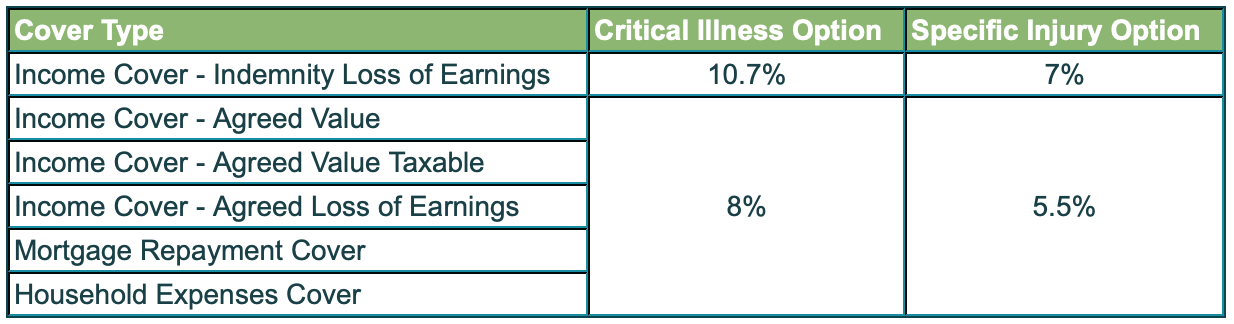

On 4 August 2023, ‘critical illness benefit’ became ‘critical illness option’, and ‘specific injury benefit’ was renamed ‘specific injury option’. Deselecting either on the online application form will trigger a premium discount.

Specific injury and critical illness can be de-selected (above).

Partners Life says that for existing Partners Protection Plan policy owners, these options will show as selected, but can be deselected. A revised premium will be applied following the client’s signed request being submitted.

The firm also states that these new options and associated premiums may not be reflected immediately in external market comparison software…”we are working with them to have these updated as soon as possible”.

An opt-out option for Partners Life trauma cover TPD will launch in October.

See our report: Partners Life Introduces Lower Fees